Curious if an AI inventory buying and selling bot can ship actual leads to at this time’s unstable market?

I spent weeks linking eight prime instruments to dealer APIs (like Alpaca, IBKR), working them on real-time US inventory knowledge, and gauging usability, logic, and efficiency.This text breaks down what every bot does—who it’s supreme for and what to observe for.

Why Use an AI Inventory Buying and selling Bot?

Inventory bots can free you from emotional buying and selling, scan markets tirelessly, check hypotheses with backtesting, execute entries and exits with precision, and handle danger on autopilot. However not all bots are created equal—some supply deep AI perception, others simply set off orders from alerts. Understanding the distinction issues.

⬇️ See the top AI trading bots

Key Analysis Standards

- Core options & technique sorts (sample AI, swing, pattern, rule‑logic)

- Brokerage automation and setup with US brokers

- Ease of use—templates or code‑required?

- Pricing & trial flexibility

- Belief & transparency (knowledge, sign high quality, consumer suggestions)

Finest AI Inventory Buying and selling Bots That Really Work

Core Options

- Provides single‑ticker AI Buying and selling Brokers (“Sign,” “Digital,” “Brokerage”) utilizing machine‑studying fashions (FLMs)

- Candlestick sample scanners

- Backtested algorithms.

Finest For

Merchants wanting plug‑and‑play sample recognition on one inventory or ETF.

Opinion

Nice for entry-level customers. Setup is painless, and you’ll subscribe to a NVDA‑targeted agent and watch trades fireplace. The constraints: not multi‑image technique and comparatively rigid.

Core Options

- AI‑pushed commerce methods like Trad3r

- Automated side-by-side execution

- Targets ~4% month-to-month returns through statistical fashions and sample recognition. Contains consultations for busy professionals

Finest For

Customers wanting set-and-forget automation backed by AI analytics.

Opinion

Guarantees are daring (~4% month-to-month), and onboarding is easy. Nonetheless, public path knowledge is proscribed—so belief grows over time.

Core Options

- Actual-time sign engine with AI Inventory Picker

- Swing buying and selling modules

- Sentiment & elementary integration

- InvestGPT chat, copy‑prime‑investor portfolios

Finest For

Analytical merchants who select trades, not blindly auto‑execute.

Opinion

Indicators are sensible and assorted; you get context, not simply alerts. No auto-execution (alerts → guide/bot), however depth is spectacular.

Core Options

- No-code rule builder (IF–THEN logic)

- Technique market, backtesting, integrates with Alpaca for reside buying and selling on NASDAQ/US shares.

Finest For

Customers wanting easy automation with out code, prebuilt guidelines or shared methods.

Opinion

Coinrule is user-friendly. I constructed a moving-average cross rule in minutes and linked it to Alpaca—trades fired cleanly. Backtesting helps refine danger.

Core Options

- Holly AI engine

- TradeWave momentum module

- OddsMaker backtesting, inventory race visible instruments, dealer integration (IBKR)

Finest For

Lively swing/day merchants who need high-end sign scanners and AI-curated commerce setups.

Opinion

TradeIdeas is the Cadillac of inventory buying and selling bots. Scans are deep, updates quick, Holly’s pre-market concepts are slick—however it is advisable to customise scans and hyperlink to brokerage. Steep studying curve, however energy consumer materials.

Core Options

- Though primarily crypto

- Bitsgap presents multi-asset sensible execution and portfolio monitoring for crypto.

- Not stock-supported

Finest For

Crypto merchants—not inventory customers.

Opinion

Bitsgap shines for crypto; not related to inventory buying and selling situations. Talked about right here for readability solely.

Core Options

- Not a bot itself however the final technique editor utilizing Pine Script, customized alerts, charting indicators

- Integrates through third-party connectors like WunderTrading, Tickerly

Finest For

Merchants who construct or purchase their very own methods and want transmission to dealer.

Opinion

TradingView is the center of contemporary retail buying and selling. Constructing methods in Pine Script after which automating through connectors offers most flexibility—however setup takes effort.

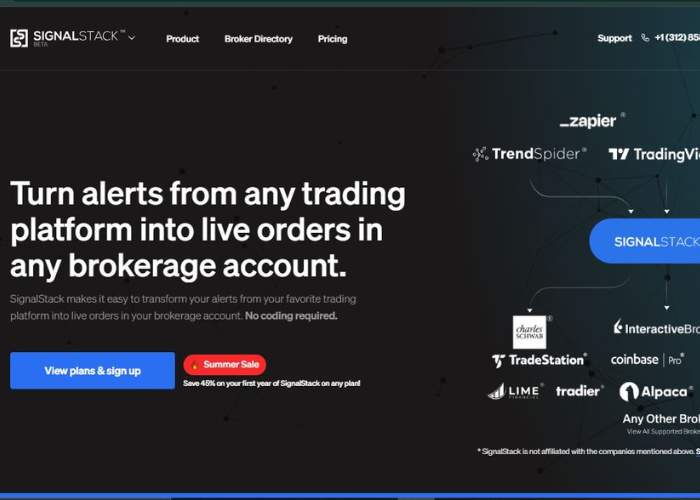

Core Options

- Executes incoming alerts from TradingView or TrendSpider as actual orders throughout 30+ brokerages

- Llatency below 0.5s, no coding required

Finest For

These constructing methods elsewhere and needing dependable dealer execution.

Opinion

When you script alerts in TradingView and need seamless automation, Sign Stack is an ideal bridge. Not a technique device, however execution is quick, dependable, and value‑environment friendly.

Comparability Desk

| Software | Finest For | Technique Sort | Execution Methodology | Ease of Use |

| Tickeron | Single-ticker sample bots | Prebuilt ML bots | Native robotic API | Very simple |

| Aterna AI | Passive automation through AI | Sample/stats AI | Native execution | Straightforward |

| Intellectia | Knowledge-driven swing buying and selling | AI alerts & sentiment | Alert/guide execution | Average |

| Coinrule | Rule-based automation | IF‑THEN triggers | Alpaca automated | Newbie-friendly |

| TradeIdeas | Scan-heavy energetic day merchants | AI scanned momentum alerts | Alert to dealer | Superior |

| Bitsgap | Crypto-focused automation | Crypto bots solely | Native crypto API | Crypto use solely |

| TradingView | Technique coders and scanners | Customized Pine methods | By way of connector (third social gathering) | Customizable |

| Sign Stack | Alert execution bridge | Any alert-system technique | Quick dealer execution | Lean & dependable |

Conclusion & High 3 Suggestions

After in depth testing and evaluation:

- TradeIdeas wins for energy customers chasing high-end AI scanning and commerce sign era. Excellent if you happen to’re critical about day/swing buying and selling with dealer automation.

- Coinrule earns finest usability award. If you need sensible automation with out code, and fast Alpaca integration for US shares, it’s arduous to beat.

- Signal Stack is finest for these constructing their very own alerts—dependable, lean execution that turns alerts into actual dealer trades. Superb for clear automation.

Honorable Mentions:

- Intellectia for signal-driven merchants preferring choice assist over full automation.

- Tickeron for single-symbol publicity followers looking for pattern-based bots.

- Aterna AI if you happen to belief their AI technique mannequin and need hands-off buying and selling.

When you’re a newbie, begin with Coinrule. For extra management, construct Pine scripts in TradingView and use Sign Stack. When you’re assured and want superior scanning, go along with TradeIdeas.

Every device has a candy spot—decide based mostly on how hands-on or passive you need your AI buying and selling to be.