In the event you run a distribution enterprise, you recognize the drill: A buyer rejects an bill over a purchase order order discrepancy, their cost phrases reset, they usually sit in your working capital when you pay 9%+ curiosity.

Let’s discover how a mid-sized distributor solved this by scaling their buy order-sales order verification course of earlier than transport – with out including headcount or disrupting present workflows.

The actual value of order discrepancies in distribution

Order discrepancies usually slip via to post-shipping discovery. It is inevitable while you’re processing 1000’s of orders month-to-month. However when your buyer rejects an bill as a result of their buy order (PO) would not match your gross sales order (SO), they are not simply making a headache — they’re holding onto your working capital.

For one mid-sized distributor processing 4,000 orders month-to-month, this meant vital prices and strained accounts receivable cycles. Their accounting workforce may solely manually confirm SOs towards POs when the worth exceeded $10,000, leaving most shipments susceptible to expensive discrepancies.

At present rates of interest above 9%, each delayed cost hit onerous. As soon as supplies are delivered, prospects have zero urgency to repair these points. Every bill revision resets cost phrases, making a expensive cycle of delays and dealing capital constraints. Past that, these discrepancies may additionally frustrate prospects and doubtlessly result in the lack of future enterprise.

💡

Why stopping order discrepancies is extra complicated than it appears

In distribution, matching POs and SOs is not nearly evaluating numbers. Your prospects would possibly record 10-inch 600-pound stainless-steel when you present 10-inch 600# SS. Some ship two-page POs, and others ship 60 pages with elaborate phrases and situations. Add a number of plant areas, various cost phrases, and lot cost orders — verifying orders earlier than success turns into more and more difficult.

The distributor’s order processing workflow earlier than automation was typical of many industrial suppliers.

Order discrepancies create expensive downstream issues

Past the apparent time constraints, manually evaluating SOs towards POs created a number of downstream issues that worsened over time.

This is what was taking place:

- Solely orders above $10,000 could possibly be manually checked — leaving most orders unverified

- Every guide matching took half-hour of senior accounting supervisor’s time

- Smaller orders have been shipped with out correct verification, carrying hidden dangers

- Discrepancies surfaced solely throughout invoicing, resulting in bill rejections

- Working capital and accounts receivable tied up for 60-90 days at ~9.5% curiosity

- Points found after transport when prospects had no urgency to repair

- Technical half descriptions diverse between prospects and inner programs (Instance: ZP vs zinc plated), complicating guide checks

- A number of transport areas shared zip codes however wanted totally different gate numbers, risking supply errors and expensive reshipments

The time and value funding was substantial. As an instance the accounting supervisor is making round $60.44/hour (median hourly wage for the role in the US) — that is a senior expertise you are paying to match POs line by line manually. For this distributor, with 734 high-value orders yearly and half-hour per examine, that meant burning via $22,181 simply on guide verification. And we’re not even counting the hours spent chasing corrections and different further duties.

Moreover, the cost clock resets each time a buyer rejects an bill because of a discrepancy with the PO. So, at 9.5% curiosity, a 60-day delay on a single $10,000 order value them $158 in curiosity alone. Now multiply that throughout a whole lot of orders. Abruptly, these minor verification points are bleeding tens of 1000’s in curiosity prices yearly.

The distributor knew they wanted to catch PO-SO discrepancies earlier than transport—after they nonetheless had leverage to get points fastened. However any resolution wanted to work alongside their present order processing and success workflow, not exchange it. That is after they approached us at Nanonets.

How we automated PO-SO matching

On this distributor’s case, automating order verification required vital change administration. Whereas we may automate your entire workflow from order entry to transport, we knew that may contain retraining the gross sales workforce and disrupting established processes.

That is why we started by automating how they verified their gross sales orders towards buy orders.

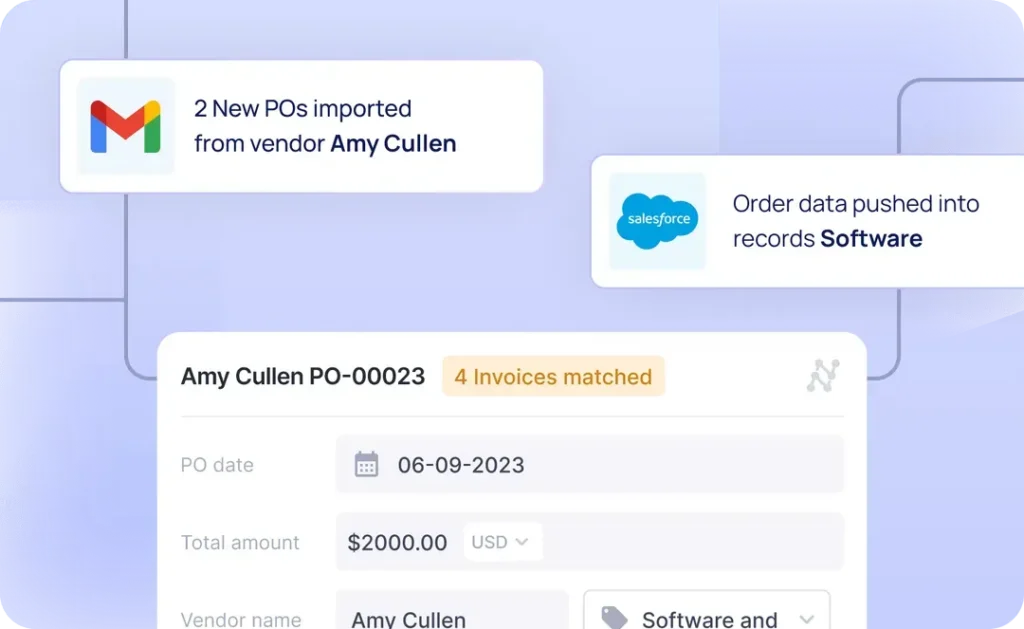

We realized we may ship fast worth right here. Nanonets built-in with the distributor’s Enterprise Edge ERP and doc administration system – streamlining buy and gross sales order seize. This manner, the gross sales groups may maintain their present workflow whereas the automated order matching ran within the background, catching discrepancies earlier than they grew to become expensive issues.

Right here’s what the workflow appeared like:

- Gross sales workforce receives buy order and creates gross sales order as ordinary

- Buy order will get uploaded to their doc administration system

- Our system robotically detects new buy orders

- System pulls corresponding gross sales order particulars from Enterprise Edge

- System verifies gross sales order particulars towards buy order

- Discrepancies get flagged earlier than transport

- Order processing workforce receives alerts for assessment

- All verifications get logged for monitoring and evaluation

The implementation course of

Working with the distributor, we took a phased method. We began with their highest-value orders above $10,000. This allowed them to benchmark our system towards their present guide verification course of whereas minimizing danger. In addition they categorized their prospects based mostly on verification wants — some required precise matches on each area, whereas others primarily centered on totals and portions.

We labored with the distributor to coach our system to deal with these PO-SO variations. This included:

- Dealing with complicated layouts, codecs, and emailed orders

- Managing a number of plant areas

- Understanding numerous product descriptions

- Processing totally different cost time period codecs

We arrange a number of day by day checks throughout enterprise hours (7:30 AM – 4:30 PM CT). The system periodically checks for brand spanking new buy orders, pulls the corresponding gross sales order particulars from Enterprise Edge, and runs the verification course of — all within the background.

The system then robotically flags points based mostly on severity:

Important points requiring fast consideration:

- Complete quantity mismatches

- PO quantity discrepancies

- Cost time period variations

Non-critical points for assessment:

- Delivery element variations

- Line merchandise matches

- Tackle format variations

This new automated workflow helped centralize their verification course of, with a devoted order processing position dealing with all system alerts. This ensured constant processing of flagged gadgets and exceptions whereas sustaining effectivity.

The impression of automated PO-SO matching on order processing

Inside 90 days, we helped them obtain a 90% STP (Straight By means of Processing) charge — the share of orders being verified robotically with none guide intervention — and 90% accuracy in information extraction and matching. This was a major enchancment from the preliminary 70-75% accuracy charge throughout early implementation.

The outcomes have been transformative:

Operational enhancements:

- Simply processing 17-18 information day by day via automated order matching

- Error charges diminished to only 1-2 points per batch requiring guide assessment

- Automated checks operating all through enterprise hours (7:30 AM – 4:30 PM CT)

- Deal with complicated distribution situations like will-call orders and a number of transport areas via customized guidelines

- Automated order matching protection expanded to all incoming orders – no extra $10,000 threshold

- Early PO-SO verification smoothed out downstream 3-way matching processes

- Decreased order cycle time from receipt to transport

Monetary and money move impression:

- Order discrepancies caught earlier than transport — when fixes are simpler

- Cost delays diminished via pre-shipping verification

- Decreased publicity to 9.5% rates of interest on delayed funds

- Senior accounting expertise redirected to strategic work

- Higher working capital administration via quicker bill reconciliation

- Curiosity prices minimized by stopping 60+ day cost delays

Course of enchancment:

- Centralized processing via devoted order processing position

- System robotically flags points based mostly on severity

- Actual-time alerts despatched to related workforce members

- Complete monitoring via Energy BI dashboards

- Customized validation guidelines for particular buyer necessities

- Automated exception flagging and evaluations changed guide line-by-line matching

The success led the distributor to create a devoted order processing place, dealing with the small proportion of orders that wanted human assessment. This streamlined method maintained each the excessive STP charge and accuracy whereas scaling to deal with their full order quantity.