Credit score: https://creativecommons.org/licenses/by-sa/3.0/deed.en

Even because the HPC-AI sector cheers on extra highly effective chips, denser servers, quicker materials, larger reminiscence and mammoth, multi-hundreds of billion-dollar AI knowledge facilities, a voice is whispering within the trade’s ear: “The place’s the electrical energy for all this?”

Good level! It’s typically assumed the info middle power hole shall be crammed by some mixture of extra environment friendly techniques and extra methods of producing larger energy. Together with fossil fuels, the main focus is on new, ideally clear, power sources, a mixture of photo voltaic, wind, hydrogen and, possibly sometime, fusion.

Relating to nuclear energy, Deloitte Insights has launched a report, with blended conclusions.

The excellent news – good, that’s, should you’re not essentially against nuclear power – is that it’s present process a revival and it’s just about carbon-free. Alternatively, it’s going to at greatest solely partially shut the power hole.

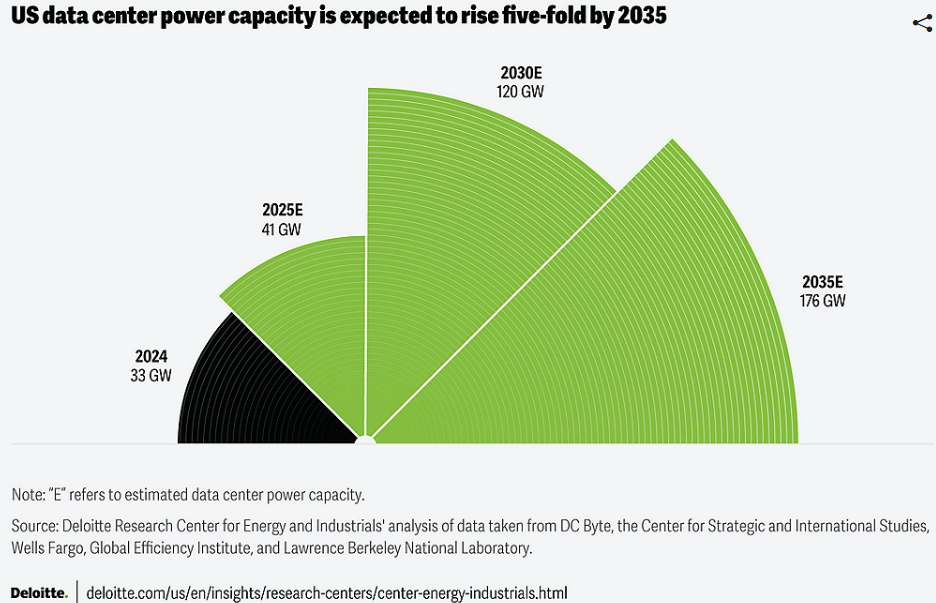

In response to Deloitte’s report, knowledge middle electrical energy demand might rise five-fold by 2035, to 176 GW, and the agency mentioned nuclear energy capability “might doubtlessly meet about 10 p.c of the projected enhance in knowledge middle energy demand over the following decade. This estimate is predicated on a major growth of nuclear capability, ranging between 35 gigawatts and 62 GW throughout the identical interval.”

At present, nuclear power powers practically 20 p.c of U.S. electrical energy regardless of representing lower than 8 p.c of the nation’s complete working capability. Nevertheless, the nation’s nuclear useful resource is growing older: the U.S. has 94 working reactors with a mean age of 42 years.

Deloitte Insights reported that greater than 80 p.c of those reactors have been relicensed to function for as much as 60 years and even 80 years with a subsequent license renewal. Upgrades and modernization of those reactors might increase capability. Deloitte cited sources reporting that “The cumulative uprates from 1977 to 2021 quantity to eight,030 MW, averaging about 0.18 GW per yr over 44 years.”

As well as, reviving closed vegetation, as Microsoft intends to do with the previous Three Mile Island plant in Pennsylvania, is an alternative choice that’s cheaper than constructing new vegetation of comparable capability, Deloitte mentioned.

Different tasks name for constructing new reactors at current nuclear and coal-fired energy websites, “benefiting from current infrastructure and streamlined licensing processes.”

One other method is small modular reactors (SMRs). These factory-built reactors provide potential advances over conventional nuclear reactors, Deloitte mentioned, together with “black begin functionality, islanding, underground building, gasoline safety, and steady operation, making them extremely resilient and appropriate for infrastructure like knowledge facilities.”

Relating to next-generation reactor designs Deloitte mentioned they’ve the potential to “improve security, effectivity, and gasoline utilization, and microreactors provide distinctive benefits for distant places, off-grid purposes, and specialised power wants, making them viable choices for powering knowledge facilities.”

As well as, SMRs “drastically cut back building timelines” and may improve security, incorporating “passive security techniques (gravity, pure circulation), doubtlessly decreasing the necessity for operator intervention. The smaller core and decrease energy density additional reduce dangers. Some designs even incorporate underground building for added safety.”

Nevertheless, nuclear energy stays a controversial power supply. As Deloitte said, “public opinion on nuclear energy in the USA is complicated and evolving, and so the trail to scaling it for knowledge middle demand shouldn’t be with out challenges.”

As well as, nuclear vegetation usually face prolonged regulatory approval cycles and “typically face challenges associated to building timelines and value overruns, which may hinder their financial viability and competitiveness with different power sources,” Deloitte reported, citing a commercialized mission that went over price range by greater than 114 p.c and was delayed six years.

Nuclear energy plant building is dear. Deloitte cited a supply reporting that “In 2024, the capital expenditure to develop nuclear services ranged from US$6,417 to US$12,681 per kilowatt (kW), whereas that of pure fuel services was about US$1,290 per kW.”

On the upside, nuclear affords dependable baseload energy, working 24/7 no matter climate circumstances, in contrast to wind and photo voltaic. Nuclear additionally has a better capability manufacturing unit than pure fuel, 92.5 p.c vs. 56 p.c.

And nuclear is scalable. Deloitte’s report said that “a single nuclear reactor usually generates 800 megawatts (MW) or extra of electrical energy, readily assembly the ability calls for of even the biggest knowledge facilities (50 MW to 100 MW) and the burgeoning necessities of AI-focused services (as much as 5,000 MW).”

In all, nuclear affords promise, perils and a partial resolution for the power hole.

The complete report can be found here.