A number of years earlier than Donald J. Trump entered politics, Apple and its companions constructed large factories throughout China to assemble iPhones. Mr. Trump first campaigned for president by promising his supporters that he would power Apple to make these merchandise in America.

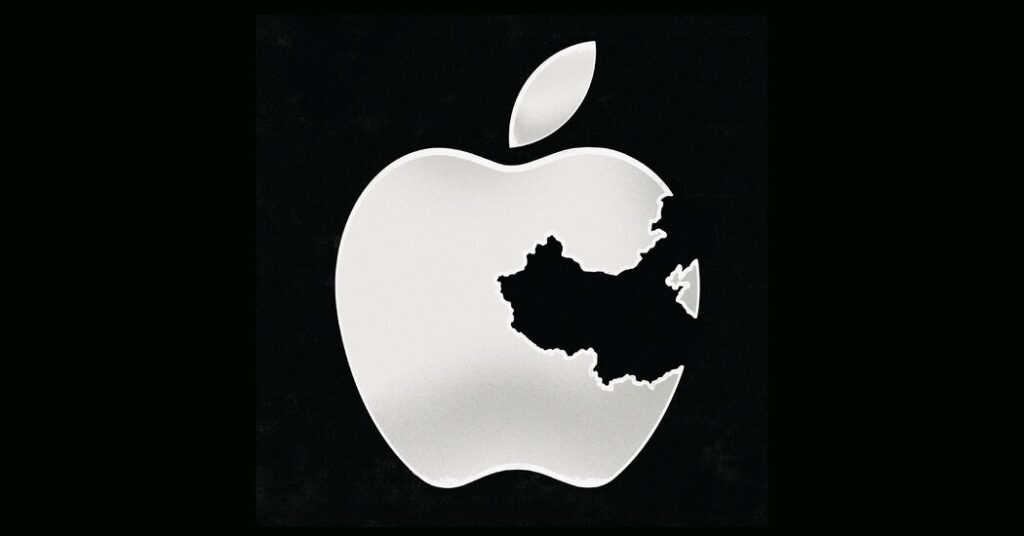

Practically a decade later, little has modified. As an alternative of bringing its manufacturing residence, Apple shifted some manufacturing from China to India, Vietnam and Thailand. Virtually nothing is made in America, and an estimated 80 % of iPhones are nonetheless made in China.

Regardless of years of stress, Apple’s enterprise continues to be so depending on China that the tech large can’t function with out it. Strikes by the Trump administration to alter Apple’s habits danger damaging the world’s Most worthy publicly traded firm. And any critical effort to maneuver Apple’s manufacturing to america — if that’s even doable — would take a titanic effort by each the corporate and the federal authorities.

Within the 4 days after President Trump introduced taxes on Chinese language exports of 145 % final month, Apple misplaced $770 billion in market capitalization. It regained a few of these losses after Mr. Trump gave shopper electronics producers in China a short lived reprieve.

On Thursday, Wall Road analysts count on Apple to report that gross sales elevated 4 % in the latest quarter, partly as a result of individuals rushed to purchase iPhones earlier than the tariffs kicked in. The report affords Wall Road analysts a possibility to grill Apple’s chief government, Tim Cook dinner, in regards to the danger of future tariffs, worth will increase and the corporate’s future in China and america.

An Apple spokesman declined to make any firm executives accessible for this text. The corporate mentioned this yr that it might make investments $500 billion in america over the following 4 years and start making synthetic intelligence servers in Houston in 2026.

David Yoffie, a professor at Harvard Enterprise College who has written case research on Apple, mentioned the scrutiny was warranted as a result of “they’re the corporate most in danger in an entire breakdown of america and China.”

Gene Munster, a managing companion at Deepwater Asset Administration, which invests in rising know-how firms, estimates {that a} full breakdown between america and China would reduce the worth of Apple in half or extra. It might drop to being a $1.6 trillion firm from a $3.2 trillion firm as a result of a few third of its gross sales are tied to merchandise made in China, even when it shifts some manufacturing to different nations. And the worth might drop to $1.2 trillion if it additionally misplaced its gross sales to Chinese language prospects, as its rival Samsung did after a dispute between South Korea’s and China’s governments. Beijing has already discouraged iPhone purchases by authorities workers.

A significant drop in Apple’s worth would ripple by means of the inventory market. The corporate accounts for about 6 % of the S&P 500 index. Meaning for every greenback invested within the fund, about 6 cents goes to Apple inventory. Traders, and most 401(okay) house owners, would see that stake reduce in half.

Apple’s roots in China run deep. A long time in the past, the corporate labored with Beijing to arrange manufacturing in China with out making a three way partnership with a Chinese language firm, as required of many U.S. companies. It then perfected the artwork of assembling units inexpensively in China and promoting merchandise to the nation’s rising center class. The mix has earned it greater than 80 % of world smartphone earnings and generated $67 billion in annual Chinese language gross sales.

Over time, the corporate’s ties to China have strengthened. Right this moment, not solely does it make most iPhones in China, however its Chinese language suppliers additionally assemble elements for units made in India and manufacture components and AirPods in Vietnam.

Apple’s dependency on China has made its provide chain one thing of a Rorschach take a look at for the Trump administration, which needs to convey extra electronics manufacturing to america. Apple has extra energy than some other electronics firm to ship on the administration’s objective. It makes extra smartphones than anybody else and spends extra money on parts than rivals, giving it super sway over the place its suppliers function.

The Trump administration needs Apple to start that course of. In an April tv interview, Commerce Secretary Howard Lutnick mentioned that “the military of hundreds of thousands and hundreds of thousands of human beings screwing in little, little screws to make iPhones — that type of factor goes to return to America.”

However pressuring Apple to depart China might backfire. The brand new tariffs might power Apple to lift iPhone costs or settle for smaller smartphone earnings. Samsung telephones, that are made in Vietnam and never topic to Chinese language tariffs, might be cheaper by comparability. Apple might turn into much less aggressive at residence — a crimson line that Mr. Trump seldom needs to cross.

Apple has resisted making iPhones and different units in america as a result of the corporate’s operations crew has decided that it might be inconceivable, mentioned two individuals accustomed to the evaluation who spoke on the situation of anonymity. A decade in the past, it had a nasty expertise sourcing screws and discovering dependable staff to assemble a Mac laptop in Texas.

In China, Apple’s suppliers are capable of convey collectively 200,000 individuals. They work at factories supervised by hundreds of engineers with years of producing expertise. Most reside in dormitories close to the iPhone plant, the place shows and different parts transfer down meeting traces longer than a soccer subject.

Discovering that many workers and skilled engineers can be inconceivable in most American cities, mentioned Wayne Lam, an analyst with TechInsights, a market analysis agency. He mentioned Apple would wish to develop extra automated processes with robots to make up for the smaller inhabitants in america.

Mr. Lam estimates that if Apple did arrange operations in america, it might have to cost $2,000 for an iPhone — up from about $1,000 now — to maintain its present earnings. The value might drop to $1,500 in future years as the corporate lowered the prices of coaching workers and making parts.

“Within the quick time period, it’s not economically possible,” Mr. Lam mentioned. He added that it additionally made little sense to relocate manufacturing of a tool that was almost 20 years outdated and might be disrupted by a brand new gadget that caught on with shoppers.

Apple has proven a willingness to maneuver its provide chain when there are incentives. In 2017, it started a course of to make iPhones in India as a result of the nation had excessive taxes on imports that may have made costs improve to some extent the place Apple couldn’t have claimed a slice of the world’s fastest-growing smartphone market.

Right this moment, Apple makes about 20 % of its iPhones bought around the globe in India. It additionally makes some parts there, together with the steel body. But it surely depends on Chinese language firms to assemble the shows and different advanced elements.

Matthew Moore, who spent 9 years as a producing design supervisor at Apple, mentioned India had one other benefit that America didn’t: “Engineers, in every single place.”

To lure Apple and electronics firms to america, Mr. Moore believes, the Trump administration might want to spend money on training for levels in science, know-how, engineering and math. He additionally thinks that the nation ought to encourage loans for brand spanking new manufacturing amenities, a lot because it does for housing with Fannie Mae and Freddie Mac.

Final month, Apple purchased itself a short lived break. Mr. Cook dinner, who personally donated $1 million to Mr. Trump’s inauguration, lobbied the Trump administration for the exemption it gave to iPhones and different electronics from the 145 % tax on Chinese language exports. It’s momentary, although. The administration has mentioned it plans to difficulty extra focused tariffs on tech merchandise.

With out authorities investments, Apple and smaller producers will proceed making issues in China as a result of it has extra gear and engineers, mentioned Mr. Moore, who began Cruz, an organization that makes {hardware} merchandise like blenders.

“I don’t suppose the ship has sailed, but it surely’s absurd to suppose in 4 years we’re going to make iPhones right here,” Mr. Moore mentioned. “It might take 10 years.”