In Half 1, we’ve evaluated mannequin predictions utilizing a fastened threshold to resolve whether or not a prediction is constructive or unfavorable.

Machine studying fashions don’t instantly label inputs as “fraud” or “reputable.” As an alternative, they output a chance rating of how possible it’s {that a} given transaction is fraudulent. The threshold is the cut-off worth we select to show this chance right into a remaining choice. For instance, if we set the threshold at 0.5, any prediction with a fraud chance above 0.5 might be labeled as fraud; in any other case, it will likely be thought-about reputable.

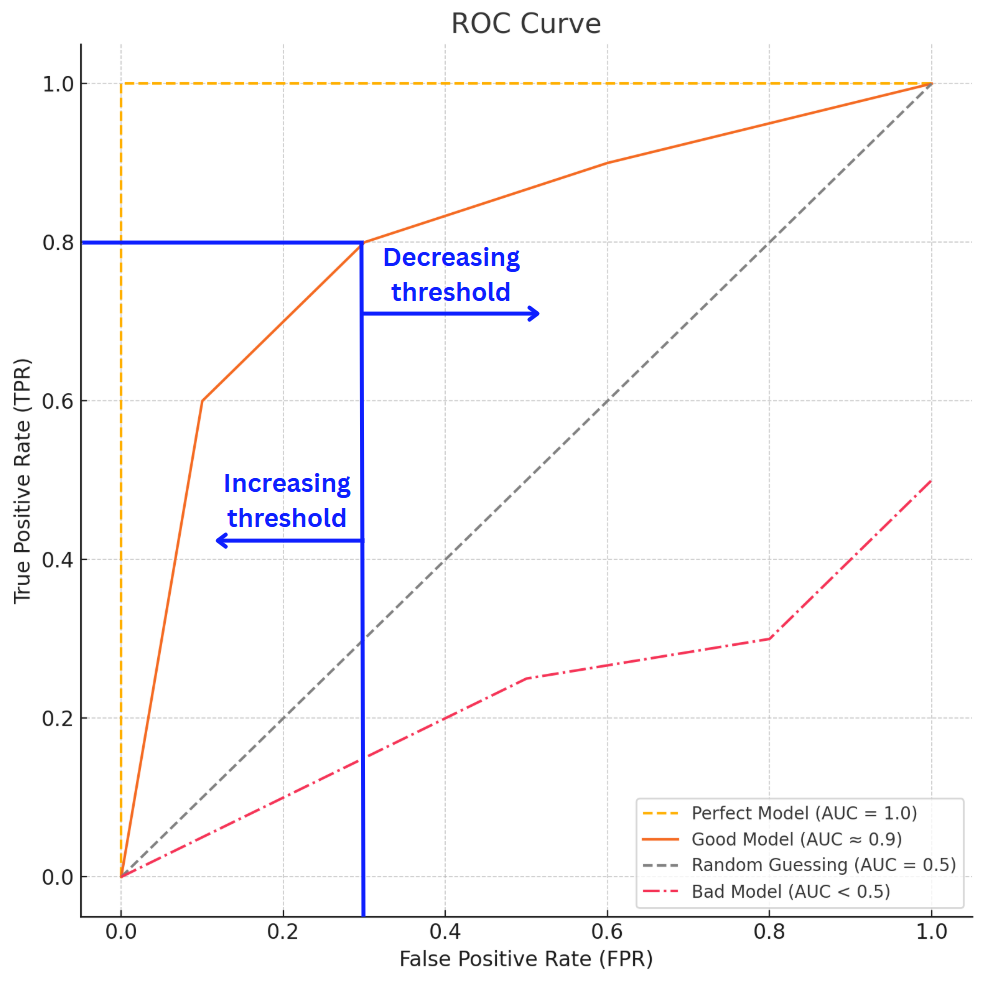

Altering the threshold adjustments the mannequin’s behaviour. It impacts what number of fraudulent transactions the mannequin catches (true positives), and what number of reputable ones it wrongly flags (false positives). To know how a mannequin performs throughout completely different threshold values, not only one, we use the ROC curve.

The ROC (Receiver Working Attribute) Curve reveals how properly your mannequin distinguishes between constructive and unfavorable courses at completely different classification thresholds.

ROC Curve solutions the query:

“How does the mannequin’s capability to separate fraudulent from reputable transactions change as we change the choice threshold?”

That is particularly helpful when:

- The dataset is balanced (constructive and unfavorable courses are comparable in measurement).

- You need to consider general mannequin efficiency throughout all thresholds.

- False positives and false negatives carry comparable significance in your utility.

Deciphering the ROC Curve

- The x-axis is the False Optimistic Price (FPR): how typically reputable transactions are wrongly flagged as fraudulent.

- The y-axis is the True Optimistic Price (TPR): what number of precise fraud instances are accurately detected.

Every level on the curve represents a special choice threshold.

- Decreasing the brink makes the mannequin extra delicate: TPR will increase, however FPR additionally will increase.

- Elevating the brink reduces false alarms (FPR drops) however would possibly miss fraud instances (TPR drops).

This trade-off shapes the curve.

Typical ROC Curve Patterns (with Fraud Detection Context)

- Excellent Mannequin: Curve jumps to the top-left (TPR = 1, FPR = 0).

Instance: The mannequin detects each fraudulent transaction and by no means flags a reputable one.

→ AUC = 1 (perfect). - Good Mannequin: Curve arches towards the top-left.

Instance: Catches most fraud instances with few false alarms.

→ AUC is excessive (e.g., 0.8 or above). - Random Guessing: Diagonal line (TPR = FPR).

Instance: Performs like a coin flip.

→ AUC = 0.5. - Dangerous Mannequin: Curve dips beneath the diagonal.

Instance: Flags reputable transactions greater than fraud, predictions are deceptive.

→ AUC < 0.5.

AUC: A Single-Quantity Abstract of ROC Efficiency

The AUC represents the general capability of the mannequin to tell apart between courses throughout all thresholds.

- AUC = 1 → Excellent separation between fraud and legit instances

- AUC > 0.5 → Some significant capability to separate the 2 courses

- AUC = 0.5 → No discrimination in any respect (equal to random guessing)

- AUC < 0.5 → Worse than random, predictions are reversed

AUC is particularly useful once you desire a fast comparability of a number of fashions’ general classification capabilities, no matter which threshold you finally select.

To be efficient, a mannequin’s TPR (True Optimistic Price) ought to typically exceed its FPR (False Optimistic Price). If the ROC curve falls beneath the diagonal (random guessing line), it’s actively deceptive.

When ROC Curves Are Most Efficient

Whereas ROC curves present a broad view of mannequin efficiency by exhibiting the trade-off between the true constructive fee and false constructive fee, they work greatest when the courses are comparatively balanced. In such instances, each false positives and false negatives carry comparable weight, and the ROC curve provides a truthful comparability throughout fashions. For instance, in conditions like sentiment evaluation or picture classification, the place constructive and unfavorable instances are extra evenly distributed, the ROC curve is usually a helpful analysis software.

When ROC Curves Are Not Sufficient

Alternatively, for imbalanced datasets like fraud detection the place fraudulent instances are a lot rarer than reputable ones Precision-Recall (PR) curves are sometimes extra informative. They spotlight how properly the mannequin identifies the minority (constructive) class and assist keep away from overly optimistic interpretations that ROC curves can typically give in these conditions.

PR Curve solutions the query:

“How properly does the mannequin discover precise fraud instances whereas minimizing false alarms, throughout completely different classification thresholds?”

That is particularly helpful when:

- You care extra concerning the constructive class (e.g., fraud).

- You have got a closely imbalanced dataset the place fraud instances are uncommon.

- You need to reduce false positives that may set off pointless investigations.

PR Curve Interpretation

- The x-axis is Recall (True Optimistic Price):

What number of precise fraud instances the mannequin accurately identifies. - The y-axis is Precision:

How most of the transactions flagged as fraud are actually fraudulent.

Every level on the PR curve represents a completely different classification threshold.

Decreasing the brink:

Catches extra fraud instances (larger recall), however may enhance false positives (decrease precision)

Elevating the brink:

Makes the mannequin extra selective (larger precision), however dangers lacking precise fraud instances (decrease recall)

This trade-off between catching fraud and avoiding false alarms shapes the curve.

Typical PR Curve Patterns (Fraud Detection Context)

- Excellent Mannequin: Curve stays on the prime (precision = 1) till recall reaches

Catches all fraud with no false alarms.

PR AUC = 1 (perfect). - Good Mannequin: Curve maintains excessive precision as recall will increase.

Detects most fraud instances whereas limiting false positives.

PR AUC is excessive (e.g., 0.8 or above). - Poor Mannequin: Precision drops rapidly as recall will increase.

Mannequin flags many reputable transactions as fraud.

PR AUC is low or near the baseline (fraud fee in your dataset).

PR AUC: Measuring Minority Class Detection

Identical to the ROC curve has AUC, the PR Curve additionally has an area-under-the-curve rating, referred to as PR AUC.

- PR AUC provides a single quantity that summarizes the mannequin’s efficiency throughout all thresholds particularly for the constructive class (fraud instances).

- A larger PR AUC means the mannequin does a higher job figuring out fraud whereas preserving false alarms low.

PR AUC values:

- 1.0 → Excellent mannequin

- Nearer to 0 → Poor efficiency

- Baseline → Roughly equal to the fraction of fraud instances in your dataset

⚠️ Take into account:

In extremely imbalanced datasets, PR AUC is commonly extra significant than ROC AUC, as a result of it focuses on how properly the mannequin handles the uncommon, vital class like fraud.

So the beneath desk summarizes particulars concerning the ROC and PR curve to assist select between them on your mannequin analysis.

You would possibly discover that ROC and PR curves don’t show threshold values by default. That is to keep away from cluttering the plot, however understanding which thresholds correspond to which trade-offs is essential for threshold tuning. Threshold tuning includes adjusting the chance cut-off that the mannequin makes use of to assign class labels, permitting you to steadiness precision, recall, or different metrics based mostly on the wants of your utility. It helps tailor the mannequin’s output to align higher with particular enterprise targets or danger tolerances. Particularly in business-critical situations, understanding the particular choice boundary that yields optimum efficiency could make an enormous distinction.

Now we’ll have a look at a hands-on instance the place we’ll discover tips on how to generate ROC and PR curves and likewise apply threshold tuning.

Step 1: Prepare the Classifier

First, you’ll want to coach your classifier. On this instance, we’ll generate an artificial dataset and use a Random Forest classifier only for demonstration functions.

from sklearn.datasets import make_classification

from sklearn.model_selection import train_test_split

from sklearn.ensemble import RandomForestClassifier

# Generate artificial information

X, y = make_classification(n_samples=1000, n_classes=2, weights=[0.9, 0.1],

n_features=20, n_informative=2, n_redundant=10, random_state=42)

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=42)

# Prepare the classifier

clf = RandomForestClassifier(random_state=42)

clf.match(X_train, y_train)

Step 2: Generate ROC and PR Curves

Subsequent, we use the educated mannequin to get chance scores and compute the corresponding ROC and Precision-Recall curves.

from sklearn.metrics import roc_curve, precision_recall_curve, auc

# Get predicted chances for the constructive class

y_scores = clf.predict_proba(X_test)[:, 1]

# Calculate ROC and PR curve values

fpr, tpr, roc_thresholds = roc_curve(y_test, y_scores)

precision, recall, pr_thresholds = precision_recall_curve(y_test, y_scores)

# AUC (Space Below the ROC Curve)

roc_auc = auc(fpr, tpr)

Step 3: Study Efficiency at Totally different Thresholds

Now let’s have a look at how efficiency metrics change with completely different thresholds. We’ll print out the primary 10 entries to get a way of how True Optimistic Price, False Optimistic Price, Precision, and Recall range.

print("=== ROC Thresholds with TPR & FPR ===")

for i in vary(min(10, len(roc_thresholds))):

print(f"Threshold: {roc_thresholds[i]:.2f} | TPR (Recall): {tpr[i]:.2f} | FPR: {fpr[i]:.2f}")

print("n=== PR Thresholds with Precision & Recall ===")

for i in vary(min(10, len(pr_thresholds))):

print(f"Threshold: {pr_thresholds[i]:.2f} | Precision: {precision[i]:.2f} | Recall: {recall[i]:.2f}")

Step 4: Visualize Commerce-offs with ROC and PR Curves

Visualizations may help you make sense of the trade-offs. Right here, we plot the ROC curve and the Precision-Recall curve.

import matplotlib.pyplot as plt

plt.determine(figsize=(12, 5))

# ROC Curve

plt.subplot(1, 2, 1)

plt.plot(fpr, tpr, label=f'ROC Curve (AUC = {roc_auc:.2f})')

plt.plot([0, 1], [0, 1], 'k--')

plt.xlabel('False Optimistic Price')

plt.ylabel('True Optimistic Price')

plt.title('ROC Curve')

plt.legend(loc='decrease proper')

# Precision-Recall Curve

plt.subplot(1, 2, 2)

plt.plot(recall, precision, label='Precision-Recall Curve')

plt.xlabel('Recall')

plt.ylabel('Precision')

plt.title('Precision-Recall Curve')

plt.legend(loc='decrease left')

plt.tight_layout()

plt.present()

Step 5: Apply a Chosen Threshold (e.g., 0.4)

Let’s say based mostly on the curves, we resolve 0.4 is an effective threshold. Right here’s how we apply it to make remaining predictions.

chosen_threshold = 0.4

y_pred_thresholded = (y_scores >= chosen_threshold).astype(int)

from sklearn.metrics import classification_report, confusion_matrixprint("=== Confusion Matrix ===")

print(confusion_matrix(y_test, y_pred_thresholded))print("n=== Classification Report ===")

print(classification_report(y_test, y_pred_thresholded))

Step 6: Routinely Discover the Greatest Threshold (Utilizing F1-Rating)

As an alternative of manually selecting a threshold, we will automate this by testing all thresholds and selecting the one with the very best F1-score. Nonetheless, you may as well use different metrics like recall or precision relying on the particular targets of your mannequin.

from sklearn.metrics import f1_score

import numpy as np

f1_scores = []

for threshold in pr_thresholds:

y_pred = (y_scores >= threshold).astype(int)

f1_scores.append(f1_score(y_test, y_pred))

# Discover the perfect threshold

best_index = np.argmax(f1_scores)

best_threshold = pr_thresholds[best_index]

print(f"n=== Greatest Threshold Based mostly on F1-score ===nThreshold: {best_threshold:.2f} | F1-score: {f1_scores[best_index]:.2f}")

Step 7: Remaining Analysis Utilizing the Optimum Threshold

Now, we classify the take a look at set utilizing the optimum threshold and generate remaining analysis metrics.

y_pred_best = (y_scores >= best_threshold).astype(int)

print("n=== Confusion Matrix (Greatest Threshold) ===")

print(confusion_matrix(y_test, y_pred_best))

print("n=== Classification Report (Greatest Threshold) ===")

print(classification_report(y_test, y_pred_best))

To sum up:

- Accuracy isn’t at all times sufficient. With imbalanced datasets, it might probably conceal severe weaknesses.

- All the time select analysis metrics that match the real-world stakes of your utility, not simply the mannequin’s paper rating.

- Confusion matrix lays out precisely the place the mannequin will get every class proper or mistaken.

- Use precision when false positives are expensive (e.g., blocking reputable funds).

- Use recall when false negatives are harmful (e.g., letting fraud slip by means of).

- F1-score balances precision and recall when each error varieties matter.

- ROC curve & AUC give a broad view throughout thresholds, helpful when courses are roughly balanced. Helpful for general mannequin comparability.

- Precision-Recall (PR) curve & PR AUC are higher for imbalanced issues; they give attention to how properly the mannequin finds the uncommon, vital class whereas limiting false alarms. Helpful for general mannequin comparability.

- Threshold tuning helps you to management the trade-off between several types of errors or optimize for a particular metric by adjusting the cut-off chance at which the mannequin decides between courses

Strategic metric choice ensures your mannequin minimizes vital errors the place the price of errors is excessive.