Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Some homebuyers are sidestepping 6% and seven% mortgage charges by tapping into assumable mortgages. These enable consumers to take over a vendor’s current mortgage, typically locked in at ultralow charges, doubtlessly saving lots of and even hundreds of {dollars} per thirty days.

Whereas most typical loans aren’t assumable, loans backed by the Federal Housing Administration (FHA), Division of Veterans Affairs (VA), or U.S. Division of Agriculture (USDA) are—if sure circumstances are met. Fewer than one in six excellent mortgages are doubtlessly assumable. Although they nonetheless signify a small share of whole transactions, assumable gross sales are slowly gaining traction.

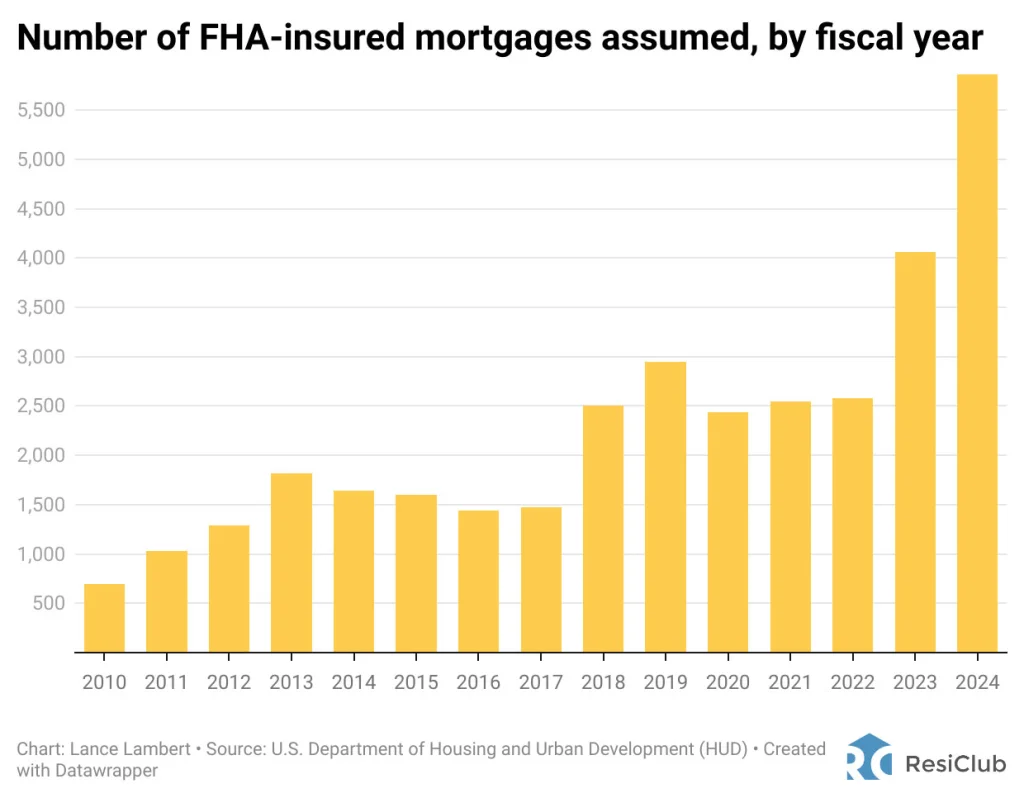

This week, ResiClub heard again from the U.S. Division of Housing and City Growth (HUD), which offered us the variety of FHA-insured mortgages assumed, damaged down by fiscal yr:

2021 —> 2,549

2022 —> 2,578

2023 —> 4,060

2024 —> 5,861

That’s a 127% enhance over the previous two years and a 44% enhance over the previous yr.

Primarily based on preliminary knowledge we seen, ResiClub expects the variety of assumed mortgages to climb even greater in 2025.

After all, there are some actual challenges with assumable mortgages:

- Not many assumable mortgages happen as a result of they require buy-in from each the customer and the vendor.

- Many people within the trade don’t precisely perceive the method.

- The customer should cowl the distinction between the excellent mortgage steadiness and the acquisition worth of the house. This typically requires a considerable down fee. For instance, if a vendor has a $200,000 mortgage on a house promoting for $300,000, the customer might want to deliver $100,000 to the desk, on high of assuming the vendor’s mortgage. Nonetheless, there are alternatives for individuals who can’t afford such a big up-front fee. Consumers could tackle extra debt and get a “blended” price, which frequently comes out round 5%.

To assist make assuming mortgages simpler, again in September 2023 Raunaq Singh launched Roam, an actual property portal that resembles Zillow.com or Realtor.com. Solely Roam solely showcases properties presently on the market with loans eligible to be assumable.

“Most individuals are shocked by this however there are literally hundreds of thousands of [potentially] assumable loans, which means the customer can take over the mortgage and switch from the vendor,” Singh beforehand advised ResiClub. “As we began to take a look at the issue we realized there can be three key points. The primary was discovery: with the ability to assist shoppers discover these properties. The second was the transparency all through the method. And the third downside was coordination: No person in the whole transaction expertise had expertise doing the belief. In case you’re the customer and also you need to assume the mortgage, you must coordinate together with your purchaser’s agent, vendor, vendor’s agent, lender, title, escrow, and shutting officer.”

New York-based Roam—which lately raised $11.5 million in a Series A spherical led by Opendoor cofounder Keith Rabois—not solely finds properties with assumable mortgages but in addition is “successfully your quarterback by way of that course of and coordinating you thru the closing,” Singh says.

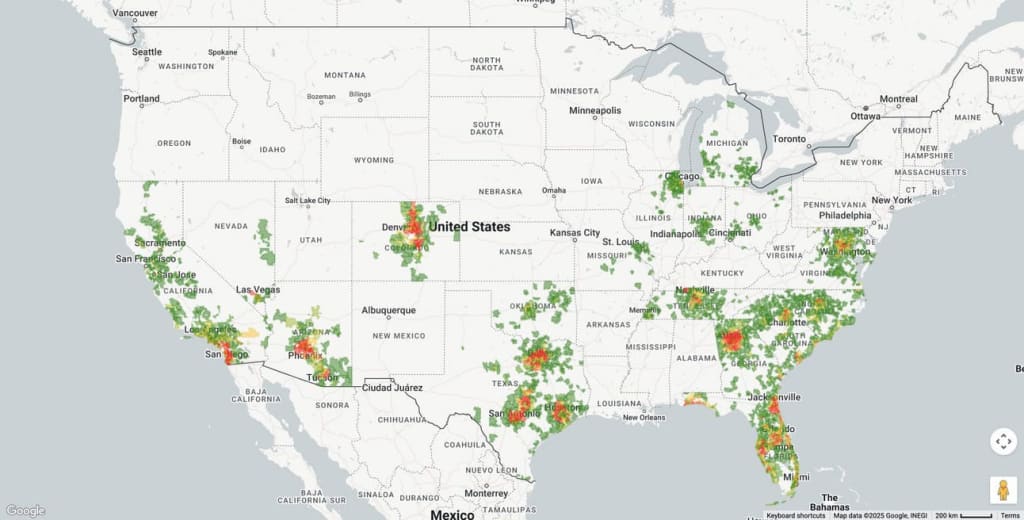

As of in the present day, Roam’s listing website solely showcases properties presently on the market with assumable loans in 18 states, together with Arizona, California, Colorado, Florida, Georgia, Illinois, Indiana, Maryland, Michigan, Missouri, Nevada, North Carolina, Ohio, Oklahoma, South Carolina, Tennessee, Texas, and Virginia.

When a vendor in these states lists their residence on the market, Roam then cross-checks it with proprietary mortgage knowledge. If that mortgage is eligible to be assumed, it’s listed on Roam’s site.

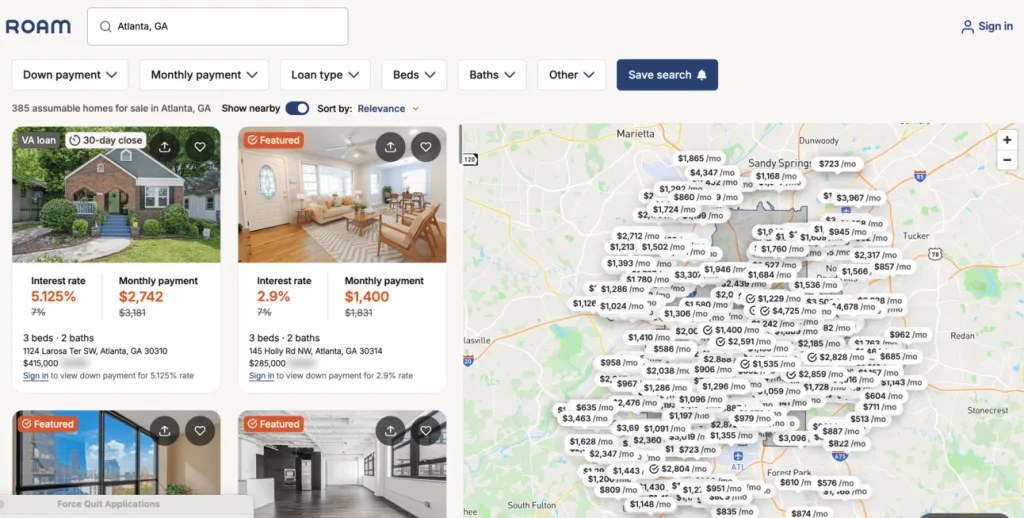

On Roam’s site, you’re requested to fill out a easy questionnaire. Then you definately’re taken to a portal to your chosen market.

I attempted it out this week and chosen the Atlanta metro market. The location then confirmed me 385 Atlanta properties on the market proper now which have loans eligible to be assumable.

How does Roam become profitable? Singh tells ResiClub that Roam is free for sellers; the corporate collects a price of 1% of the acquisition worth from the customer by way of closing prices.

In Singh’s view, householders who maintain an assumable mortgage have a bonus in the event that they plan to promote.

“They [the homeowner with an assumable mortgage] don’t know they maintain an asset, or a profit, that may unlock that sale. Early on once we began the corporate, I’d pull out an inventory of sellers who had the profit [a mortgage that could be assumable] however didn’t know and I’d name them and say, ‘Hey, your property has been available on the market for 60, 70 days. Do you know you’re burying the lede on with the ability to promote your property? You’re not promoting the No. 1 profit you’ve got,’” Singh tells ResiClub. “It’s a $1,500 month-to-month fee versus a $3,000 month-to-month fee.”

As active housing inventory for sale continues to rise, and plenty of pockets of the Solar Belt grow to be impartial or purchaser’s markets, extra sellers are keen to work with consumers to do an assumable sale, Singh says.

“We’re seeing brokers promoting Roam on their listings now as a result of they need to differentiate their itemizing vis-à-vis each different residence within the neighborhood as a result of it’s the solely residence that consumers can afford. This normally pulls in an extra three to 4 consumers per itemizing, and the median agent who does this goes below contract in 14 to 21 days after promoting their low-rate of their itemizing,” Singh tells ResiClub.

Singh provides: “An independent group of economists also studied Roam and located that sellers who embody their low price of their residence sale netted an extra 5% on their residence gross sales worth, which generally is a sturdy negotiating issue for itemizing brokers after they exit to market their residence and defend their worth level amidst worth cuts.”