Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Nationwide house costs rose 0.2% yr over yr from June 2024 to June 2025, in accordance with the Zillow House Worth Index studying printed July 17—decelerated from the three.2% year-over-year fee from June 2023 to June 2024.

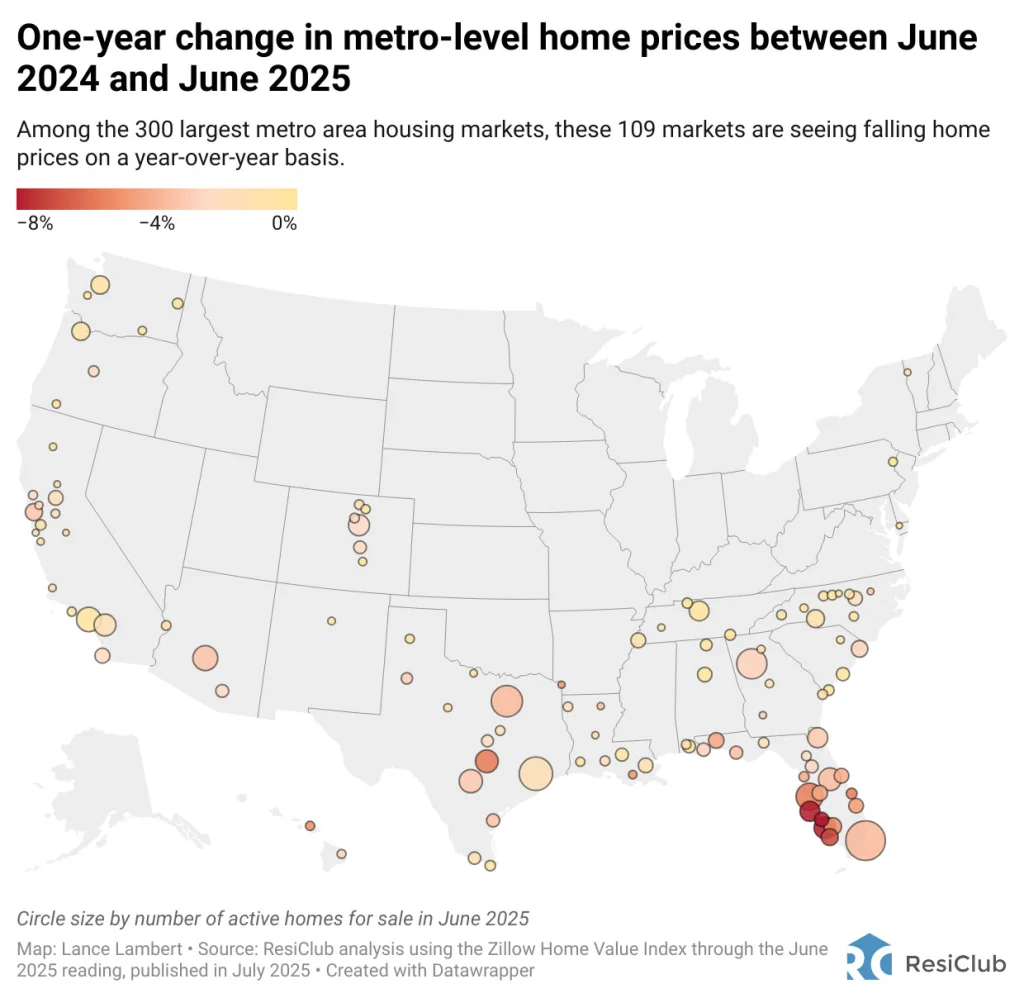

And extra metro-area housing markets are seeing declines:

—> 31 of the nation’s 300 largest housing markets (10%) had a falling year-over-year studying within the January 2024 to January 2025 window.

—> 42 of the nation’s 300 largest housing markets (14%) had a falling year-over-year studying within the February 2024 to February 2025 window.

—> 60 of the nation’s 300 largest housing markets (20%) had a falling year-over-year studying within the March 2024 to March 2025 window.

—> 80 of the nation’s 300 largest housing markets (27%) had a falling year-over-year studying within the April 2024 to April 2025 window.

—> 96 of the nation’s 300 largest housing markets (32%) had a falling year-over-year studying within the Might 2024 to Might 2025 window.

—> 109 of the nation’s 300 largest housing markets (36%) had a falling year-over-year studying within the June 2024 to June 2025 window.

Whereas 36% of the 300 largest housing markets are presently experiencing year-over-year house worth declines, that share is progressively growing as the supply-demand balance continues to shift directionally toward buyers on this affordability-constrained and post-housing increase setting.

House costs are nonetheless climbing in lots of areas where active inventory remains well below pre-pandemic 2019 levels, similar to pockets of the Northeast and Midwest. In distinction, some pockets in states like Arizona, Texas, Florida, Colorado, and Louisiana—the place energetic stock exceeds pre-pandemic 2019 ranges—are seeing modest house worth corrections.

Yr-over-year house worth declines, utilizing the Zillow House Worth Index, are evident in main metros similar to Austin (-5.8%); Tampa, Florida (-5.7%); Miami (-3.8%); Dallas (-3.7%); Orlando (-3.7%); Phoenix (-3.5%); San Francisco (-3.4%); San Antonio (-3.3%); Jacksonville, Florida (-3.2%); Atlanta (-2.9%); Denver (-2.7%); San Diego (-2.4%); Raleigh, North Carolina (-2.1%); Sacramento (-1.8%); Houston (-1.8%); Riverside, California (-1.5%); New Orleans (-1.2%); Charlotte, North Carolina (-1.0%); Memphis (-1.0%); San Jose (-0.9%); Portland, Oregon (-0.4%); Seattle (-0.1%); Los Angeles (-0.4%); and Birmingham, Alabama (-0.1%).

Click here for an interactive model of the chart beneath.

!perform(){“use strict”;window.addEventListener(“message”,perform(a){if(void 0!==a.information[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.information[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.information[“datawrapper-height”][t]+”px”;r.type.top=d}}})}();

The markets seeing probably the most softness, the place homebuyers have gained probably the most leverage, are primarily situated in Solar Belt areas, significantly the Gulf Coast and Mountain West.

Many of those areas noticed main worth surges through the Pandemic Housing Growth, with house worth development outpacing native revenue ranges. As pandemic-driven home migration slowed and mortgage charges rose, markets like Tampa and Austin confronted challenges, counting on native revenue ranges to assist frothy house costs. This softening development is additional compounded by an abundance of recent house provide within the Solar Belt. Builders are sometimes prepared to decrease costs or supply affordability incentives to keep up gross sales, which additionally has a cooling impact on the resale market. Some consumers who would have beforehand thought-about current properties are actually choosing new properties with extra favorable offers.

Given the shift in active housing inventory and months of provide, together with the gentle stage of appreciation in additional markets this spring, ResiClub expects the variety of metro areas with year-over-year house worth declines within the Zillow House Worth Index to proceed ticking up within the coming months.

This softening and regional variation shouldn’t shock ResiClub Professional members—we’ve been carefully documenting it. ResiClub Professional members can view our newest evaluation of house costs throughout 800-plus metros and three,000-plus counties here.