Getting into the world of inventory buying and selling can really feel like making an attempt to pilot a spaceship with out a guide—particularly once you hear issues like “algorithms,” “quantitative indicators,” or “neural networks.” However what if I informed you that you should use AI-powered buying and selling bots—with out writing a single line of code—and nonetheless really feel such as you’re flying the factor?

Whether or not you’re a complete newbie or somebody who simply doesn’t fancy spreadsheets and scripts, there’s a brand new breed of AI buying and selling instruments designed precisely for individuals like us: no coders, curious minds, and informal merchants.

Let’s break down what this entire AI inventory buying and selling bot factor is about, the way it can assist you, and which of them are literally value your consideration.

Why AI Buying and selling Bots Are a Huge Deal (Particularly for Newbies)

Inventory markets are emotional. Paradoxically, the neatest buying and selling choices come from not being emotional. That’s the place AI steps in. These bots analyse 1000’s of knowledge factors sooner than your human mind can blink—worth tendencies, quantity modifications, information sentiment, insider exercise—all processed with out the concern, greed, or guesswork.

However right here’s the magic: no-code AI buying and selling bots allow you to faucet into this sensible tech with out having to be taught Python or arrange your personal server. You simply plug in your preferences, tweak a number of sliders, and let the algorithm do the heavy lifting. Consider it as hiring a robo-analyst who works 24/7 and by no means asks for espresso breaks.

⬇️ See the top AI trading bots

What to Look For in a No-Code AI Buying and selling Bot

Let’s not get scammed by slick interfaces. Right here’s what you need:

- Pre-built Methods: Are there templates you should use out of the field?

- Backtesting: Are you able to check methods on historic information earlier than risking actual cash?

- Transparency: Does the platform clarify how its AI works, or is it simply black-box magic?

- Integration: Does it hook up with your dealer (Robinhood, Coinbase, Binance, and so on.)?

- Consumer Interface: Can your grandma use it? If not, rethink.

Frequent Use Instances (and Actual-Life Vibes)

- You’re a newbie who desires to “autopilot” inventory buying and selling whereas studying.

- You’re employed full-time and may’t stare at charts all day.

- You’re uninterested in meme shares and need one thing data-driven.

- You need diversification between crypto, shares, and foreign exchange.

If you happen to’re nodding alongside to any of those, the bots we’re about to debate may simply be your new buying and selling BFFs.

Desk of Contents – Greatest AI Inventory Buying and selling Bots (No Code)

- Aterna AI

- Tickeron

- Intellectia

- TradingView

- Coinrule

- Kavout

- TradeIdeas

- TradeSanta

- Bitsgap

- Signal Stack

What’s it?

Aterna AI is just like the pondering dealer’s AI assistant. It’s constructed for individuals who need AI that feels much less robotic and extra intuitive—like a buying and selling mentor that speaks your language.

Key Options

- Technique technology based mostly on conversational enter

- Customized portfolio threat profiles

- Commerce clarification layer—why it’s taking motion

- Lengthy/quick equity-focused with occasional crypto options

Use Instances

Good for individuals who wish to perceive why a commerce is made, not simply observe blindly. If you happen to’re constructing confidence and wish to develop along with your bot, Aterna’s “explainability” provides you peace of thoughts.

My Verdict

It’s a bit like having a intelligent pal whispering market ideas in your ear. Large win when you’re each curious and cautious.

What’s it?

Tickeron scans markets for technical patterns, insider exercise, and information sentiment—then serves up commerce concepts on a silver platter.

Key Options

- AI sample search engine (hiya, flags, triangles, wedges)

- Backtested commerce indicators

- Prediction Confidence Rankings (good contact!)

- Market for professional methods

Use Instances

Nice for people who wish to be taught technical evaluation alongside the way in which. You’ll be able to see how patterns result in trades and tweak them in your personal wants.

My Verdict

Visible learners, this one’s for you. The prediction graphs are borderline addictive.

What’s it?

Consider Intellectia as a knowledge geek that loves you. It focuses closely on AI-powered market forecasts, providing you with chances slightly than obscure “purchase” options.

Key Options

- Predictive fashions on equities and ETFs

- Dynamic sign technology

- Portfolio rebalance instruments

- Consumer-friendly dashboards

Use Instances

Ultimate for technique nerds who don’t wish to code however nonetheless love forecasting fashions and threat assessments.

My Verdict

It’s the AI bot for information romantics—when you love patterns, charts, and numbers, Intellectia will flirt along with your internal quant.

What’s it?

Not simply a charting platform—TradingView now integrates AI-based sign bots and third-party scripts you should use or clone.

Key Options

- Large group of script-sharing merchants

- Pine Script editor (optionally available)

- Alerts, sign bots, and integrations with brokers

- Lovely UI that makes you’re feeling sensible even once you’re not

Use Instances

Good for DIY merchants who need full management but additionally the choice to repeat smarter individuals. No-code customers can use shared methods with out touching code.

My Verdict

It’s like Reddit + Bloomberg + Excel on steroids. If you happen to wish to be taught socially, go right here.

What’s it?

Coinrule is a Lego package for buying and selling methods. “If this, then that” however for shares and crypto.

Key Options

- Drag-and-drop rule builder

- Pre-built templates for momentum, RSI, MA crossover

- Backtesting engine

- Connects to brokers like Binance, Coinbase, and a few inventory APIs

Use Instances

For tinkerers who like management however hate code. You’ll love how simple it’s to check “what if” situations.

My Verdict

Actually? One of the crucial satisfying UIs on the market. It’s the AI bot for artistic thinkers.

What’s it?

Kavout makes use of machine studying and massive information to rank shares utilizing its “Kai Rating”—a mix of fundamentals, momentum, and worth motion.

Key Options

- Kai Rating for equities

- Portfolio modeling instruments

- Information-driven insights with minimal fluff

- Integrates with hedge fund-level information

Use Instances

You need rankings, not guidelines. Simply inform me what the highest shares are, please.

My Verdict

If you happen to’re a “simply inform me one of the best” sort of dealer, Kavout hits that candy spot.

What’s it?

TradeIdeas is like caffeine for merchants. It’s speedy, loud, and sensible. Their AI, “Holly,” scans reside markets and delivers methods.

Key Options

- Actual-time concept scanner

- AI fashions that check 1000’s of methods

- Brokerage integration

- Paper buying and selling mode

Use Instances

Made for quick movers—day merchants, scalpers, and market junkies.

My Verdict

If you happen to get a rush from tick-by-tick motion, this one’s your spirit bot.

What’s it?

Initially a crypto bot, TradeSanta now helps a number of conventional belongings and presents simple automation.

Key Options

- Grid and DCA methods

- Multi-exchange help

- Easy interface

- Market of bot templates

Use Instances

Crypto-first merchants who wish to strive their hand at shares with out leaping to a brand new platform.

My Verdict

Slick and easy. Like if Coinbase made a bot—user-friendly to the bone.

What’s it?

Bitsgap connects a number of exchanges, providing you with a single management panel for all of your buying and selling bots.

Key Options

- Unified dashboard

- AI-powered bots (grid, arbitrage)

- Backtesting

- Helps crypto, foreign exchange, and indices

Use Instances

For individuals juggling accounts on a number of exchanges—nice for each crypto and conventional merchants.

My Verdict

In case your tabs are at all times overflowing, you want Bitsgap’s all-in-one view.

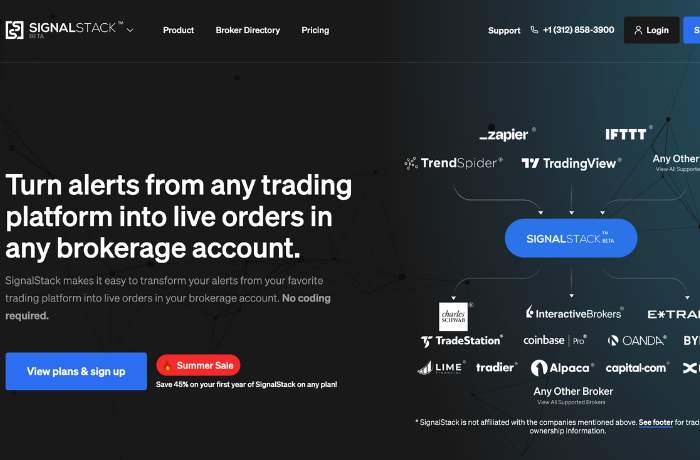

What’s it?

Signal Stack isn’t a bot itself—however it enables you to automate indicators out of your favorite instruments (like newsletters, TradingView alerts, and so on.).

Key Options

- Converts alerts into trades robotically

- Works with brokers and exchanges

- No code setup

- Webhook-based logic

Use Instances

Good for publication junkies or group sign followers—you get alerts, and Sign Stack locations the trades for you.

My Verdict

It’s automation glue. Good when you already know what you wish to commerce however don’t wish to babysit your display screen.

Ultimate Ideas & Prime 3 Picks

After diving headfirst into these platforms, right here’s how I’d sum it up:

🏆 Greatest General – Coinrule

The right mixture of energy and ease-of-use. You’ll be able to construct, check, and launch methods with out feeling such as you’re debugging a nuclear reactor.

🔍 Greatest for Studying – Aterna AI

If you wish to perceive what’s occurring and develop your abilities, Aterna makes AI explainable—and that’s value gold for newcomers.

⚡ Greatest for Quick-Movers – TradeIdeas

For the adrenaline merchants, nothing comes shut. Actual-time scans, AI-driven picks, and momentum alerts that maintain your pulse racing.