In case you’re a latest college graduate trying to launch your profession or a mid-level skilled prepared for a pivot, you is perhaps out there for an entry-level job — and questioning how a lot you’ll be able to count on to receives a commission.

Lower than half (48%) of People say they’ve emergency or wet day funds that may cowl their bills for 3 months, and about 20% of them report not having sufficient cash to pay rent or a mortgage, in keeping with Pew Research Center.

Whether or not or not your subsequent gig affords a comfortable lifestyle has rather a lot to do with its location.

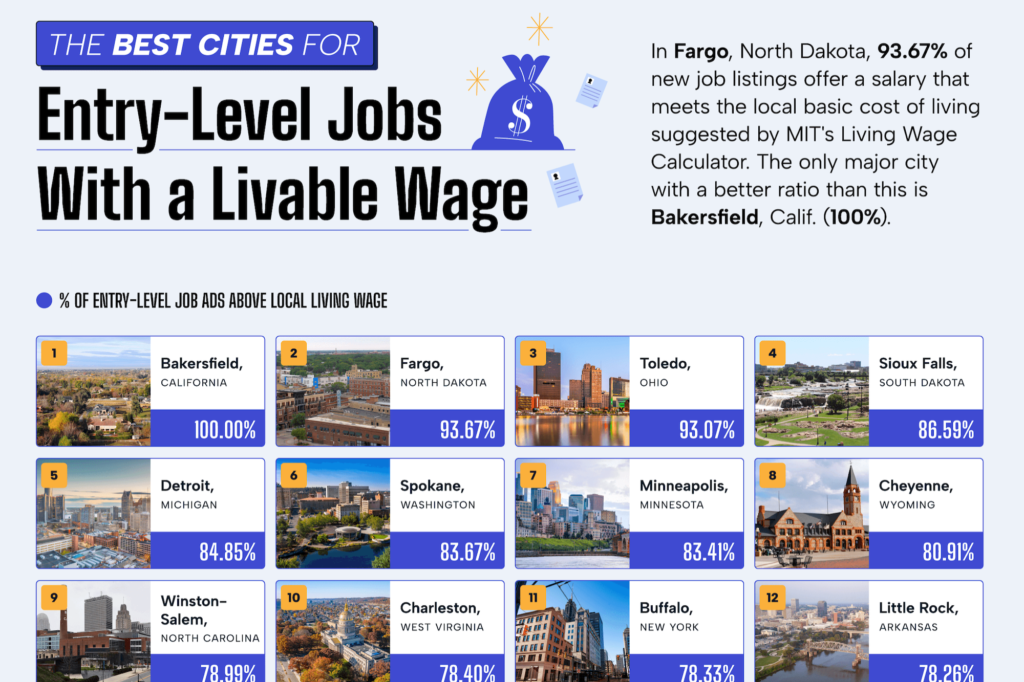

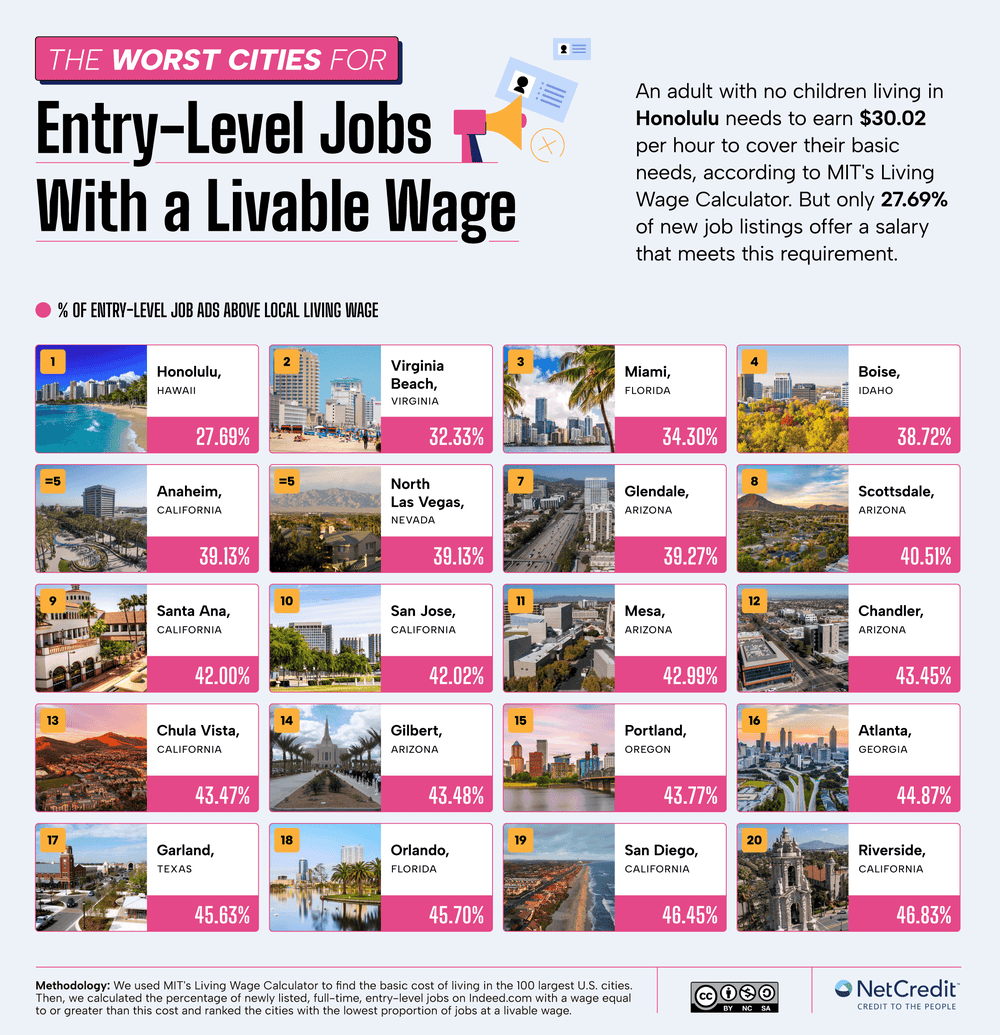

On-line lender NetCredit in contrast native entry-level job wages to native prices of residing utilizing MIT’s Living Wage Calculator and ranked states and cities primarily based on the share of job advertisements with salaries surpassing the native residing wage to determine the place folks have the most effective likelihood at success.

Because it seems, Bakersfield, California, comes out on prime, with 100% of entry-level job advertisements on Certainly promoting wages above the native residing wage, and Fargo, North Dakota, follows in second, with a 93.67% ratio, per the info.

Entry-level job candidates in Honolulu, Hawaii, might fare the worst. Simply 27.69% of recent job posts record a salary in step with the residing wage, in keeping with NetCredit. The analysis additionally confirmed low ratios in Virginia Seaside, Virginia (32.33%); Miami, Florida (34.3%); and Boise, Idaho (38.72%).

Try NetCredit’s infographics beneath for a fuller image of the analysis and livable wages throughout the U.S.:

Picture Credit score: Courtesy of NetCredit

Picture Credit score: Courtesy of NetCredit

Picture Credit score: Courtesy of NetCredit