Veryfi is a well-liked OCR software recognized for its velocity and accuracy in information extraction.

Whereas its free cell app and API integration make it versatile for a lot of customers, its limitations, equivalent to a 15-page processing cap and strict API fee limits, can hinder massive scale doc processing.

For companies needing extra versatile, superior doc processing options, exploring alternate options to Veryfi is crucial.

Stick with us as we discover the very best Veryfi alternate options with OCR capabilities that additionally present velocity, accuracy and extra flexibility.

Fast comparative desk: High Veryfi alternate options

Given the various choices accessible, selecting the suitable OCR or doc processing software may be overwhelming. That will help you make an knowledgeable resolution, we’ve got compiled a comparative desk of eight widespread alternate options to Veryfi.

| S.No. | Identify | Spotlight Characteristic | Free Trial | Pricing | High Consumer Assessment |

|---|---|---|---|---|---|

| 1 | Veryfi | Fast OCR with minimal guide intervention for expense and receipt administration. | Sure | Begins at $500/month | Quick processing, however customization choices are restricted. |

| 2 | Xero Hubdoc | Automated information seize from payments and receipts, built-in with Xero. | Sure | Included with Xero Plans | It’s handy for Xero customers however has occasional syncing points. |

| 3 | Zoho Expense | Superior expense administration with auto-scanning and multi-currency help. | Sure | Begins at $4/consumer/month | Nice for managing bills, however setup can take time. |

| 4 | Nanonets | AI-powered OCR with customizable workflows and in-built integration with ERP instruments. | Sure | Begins at $0.3/web page | Excessive OCR accuracy, intuitive interface, and fast setup. |

| 5 | Taggun | Actual-time receipt OCR API centered on velocity and ease. | Sure | $0.08/scan for underneath 5000 scans | Easy API and fast response instances. |

| 6 | Klippa | Actual-time information extraction with a give attention to safety and GDPR compliance. | Sure | Customized pricing | Consumer-friendly design and environment friendly processing. |

| 7 | DEXT | Complete expense administration with automated information extraction. | Sure | Begins at ~$230/month | Characteristic-rich however barely overwhelming interface. |

| 8 | Mindee | AI-driven doc parsing with pre-trained fashions for numerous paperwork. | Sure | Customized pricing | Straightforward integration and excessive accuracy. |

| 9 | Google Cloud Imaginative and prescient API | Sturdy picture evaluation, together with textual content detection and classification. | Sure | Characteristic-based pricing | Highly effective options however require a studying curve. |

1. Xero Hubdoc

Xero’s Hubdoc is a data capture software that streamlines monetary doc administration by mechanically extracting vital data from payments and receipts. Customers can add paperwork through e mail, cell app, or desktop, and Hubdoc processes these to create transactions in Xero, full with connected supply paperwork.

This integration simplifies reconciliation, reduces manual data entry, and ensures monetary information are up-to-date and correct.

Who ought to use Xero Hubdoc?

💡

Xero Hubdoc is right for solo merchants, new companies, and self-employed people in search of to automate monetary doc administration and streamline bookkeeping processes.

Options that matter

- Automated information seize: Extracts key particulars from payments and receipts through cell, e mail, or desktop uploads.

- Xero integration: Creates draft transactions in Xero with connected supply paperwork for straightforward reconciliation.

- Financial institution assertion conversion: Turns PDFs into CSVs for fast import into Xero.

- Safe storage: Organizes paperwork in folders with limitless storage for straightforward entry.

- Position administration: Assigns consumer roles to manage entry and guarantee information safety.

Professionals and cons of Xero Hubdoc

| Professionals | Cons |

|---|---|

| Environment friendly information extraction | Occasional sync points |

| Integrates effectively with Xero | Studying curve for brand spanking new customers |

| Saves time by automating duties | Restricted customization choices |

| Cellular-friendly for on-the-go use | Pricing could also be excessive for small companies |

2. Zoho Expense

Zoho Expense is an advanced expense management resolution that simplifies and automates financial workflows. Powered by AI, it streamlines the monitoring, reporting, and approval of business expenses for groups and people.

Zoho Expense’s auto-scan function precisely extracts key data from receipts, enabling quicker processing and decreasing guide errors. It helps multi-currency and multi-language capabilities and gives international scalability for companies of all sizes.

With a user-friendly interface and seamless integration with accounting programs, Zoho Expense empowers finance groups and decision-makers to achieve higher management over spending whereas bettering operational effectivity and decreasing prices.

Who ought to use Zoho expense?

💡

Zoho Expense is right for mid-market and enormous enterprises in search of to automate and streamline their expense administration processes. Its sturdy options,customisation capabilities and scalability make it preferrred for mid-size and enormous organizations

Options that matter

- Receipt auto-scan: Mechanically extracts data from receipts to create bills.

- Coverage compliance: Enforces company expense policies to make sure adherence.

- Multi-level approvals: Configures customized approval workflows for expense stories.

- Actual-time analytics: Offers insights into spending patterns and traits.

- Cellular accessibility: Permits expense reporting through cell gadgets.

- Bank card integration: Syncs company card transactions for straightforward reconciliation.

- Per diem administration: Automates every day allowances for enterprise journey.

- Multi-currency help: Handles bills in numerous currencies with computerized conversion.

- Customizable fields: Tailors expense varieties to satisfy particular enterprise wants.

- Seamless integrations: Connects with accounting and ERP programs for streamlined operations.

Professionals and cons of Zoho Expense

| Professionals | Cons |

|---|---|

| Consumer-friendly interface | Restricted integration with some apps |

| Sturdy cell app for expense monitoring | Delays in buyer help |

| Options like auto-scan and approvals | Bank card syncing points reported |

| Aggressive pricing for enterprises | Customization might have a studying curve |

| Common updates with new options | Setup may be time-consuming initially |

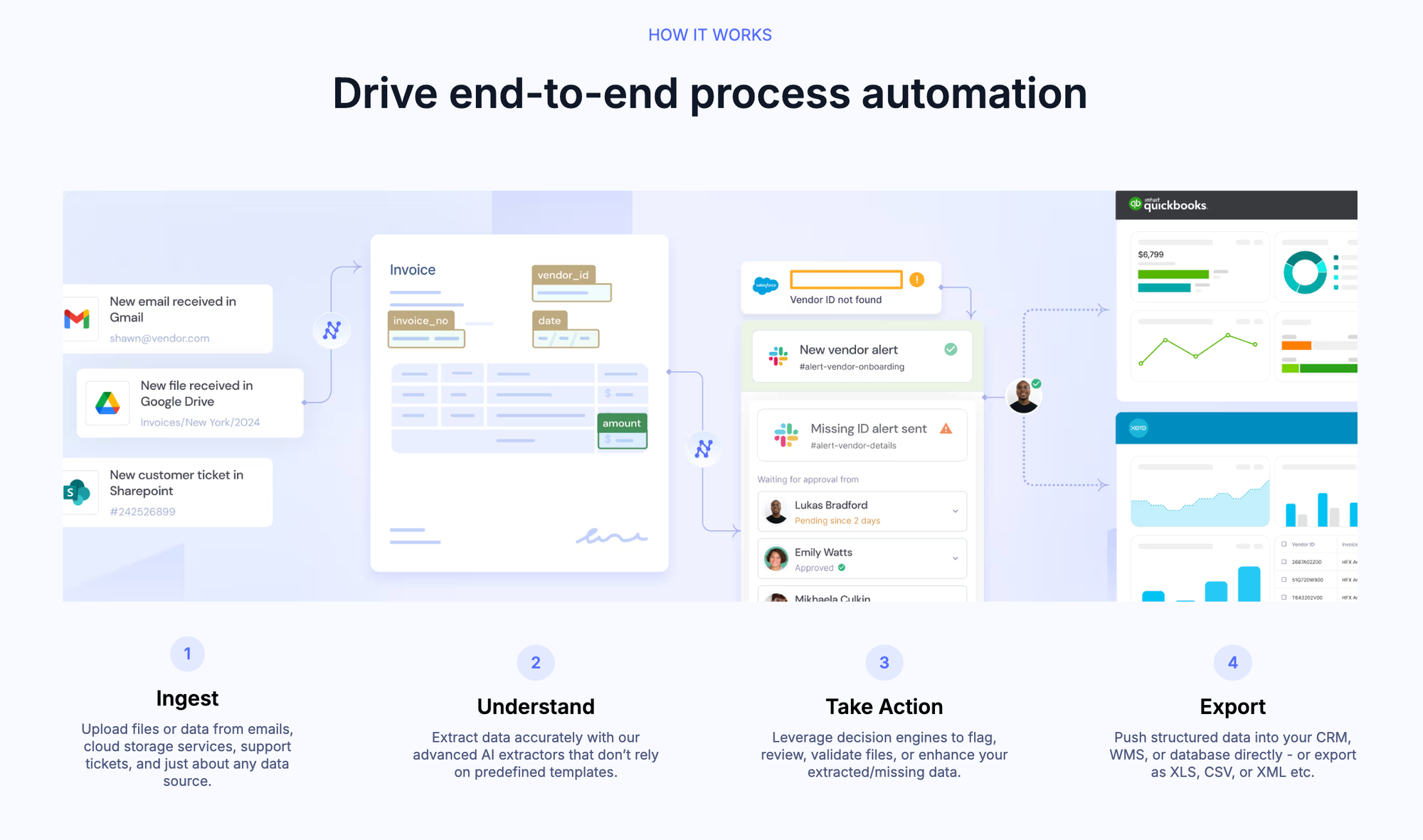

3. Nanonets

Nanonets OCR‘s superior capabilities in automated document processing enable companies to ingest information from numerous doc sorts, together with invoices, receipts, contracts, financial institution statements, IDs, and declare varieties. This achieves over 90% accuracy throughout the 10M+ month-to-month information processed globally.

Nanonets helps automate duties like approval workflows, information validation, and matching processes with a user-friendly interface, in depth OCR API integrations, and learnable resolution engines.

It reduces human errors, accelerates turnaround instances (6x quicker), and gives vital value financial savings (30%+). Supporting 100+ languages and unmatched semantic understanding, it stands out by enabling zero-training fashions to course of paperwork immediately.

Who ought to use Nanonets?

💡

Nanonets is right for medium to massive companies in search of to automate advanced doc workflows with correct AI fashions and customizable integrations.

Options that matter

- AI-powered automation: Processes structured and unstructured paperwork with 90%+ accuracy.

- Doc help: Handles invoices, receipts, contracts, IDs, and extra.

- Multi-language: Helps 100+ languages, together with Polish and Czech.

- Quick processing: Reduces time per web page from minutes to seconds.

- Value financial savings: Cuts 30%+ on guide processing prices.

- Export choices: Integrates with CRMs, WMS, databases, or exports as XLS/CSV/XML.

- Scalable: Processes 1000’s of paperwork and automates workflows with out growing group measurement.

- 24/7 availability: All the time-on AI for steady operations.

- Tailor-made options: Helps claims, onboarding, AP automation, and stock administration.

Professionals and cons of Nanonets OCR

| Professionals | Cons |

|---|---|

| Extremely correct AI fashions remove template dependency | Premium pricing for low-volume customers |

| Processes advanced unstructured paperwork | Mannequin coaching requires setup time |

| Superior desk and line recognition | The interface wants extra streamlining |

| Handles poor-quality scans effectively | Some options have a studying curve |

| Constructed-in integration with QBO, Xero, Sage, Netsuite |

4. Taggun

Taggun gives a sophisticated OCR API designed to transform receipts and invoices into structured information effectively. With help for over 85 languages, it processes numerous codecs, together with photos and PDFs, guaranteeing excessive accuracy in data extraction.

Taggun’s machine studying fashions deal with numerous regional information factors, equivalent to Australian Enterprise Numbers and Brazilian CNPJs, catering to international enterprise wants effectively.

It facilitates seamless integration into functions, enabling real-time receipt scanning and validation.

Who ought to use Taggun?

💡

Taggun is right for mid-sized to massive software program corporations, fintech companies, and e-commerce platforms that want real-time, automated, and correct receipt and bill scanning.

Options that matter

- Actual-time processing: Immediately converts receipts and invoices into structured information.

- Multi-language help: Handles over 85 languages for international applicability.

- Versatile file compatibility: Processes numerous codecs, together with JPEG, PNG, GIF, and PDF.

- Excessive accuracy: Delivers over 90% accuracy in information extraction.

- Line merchandise extraction: Captures detailed product data from receipts.

- Customizable API: Provides a developer-friendly API for seamless integration.

- Receipt validation: Validates receipts for loyalty applications and fraud detection.

Professionals and cons of Taggun

| Professionals | Cons |

|---|---|

| Straightforward API integration with clear docs | Occasional inaccuracies in detection |

| Fast and correct OCR processing | Restricted options in lower-tier plans |

| Helps a number of languages globally | Pricing could also be excessive for small companies |

| Responsive buyer help | Slower API response throughout peak instances |

| Versatile pricing for scaling | Superior options want further setup |

5. Klippa

Klippa makes a speciality of AI-driven document automation options designed to streamline enterprise processes. Their flagship product, Klippa DocHorizon, gives clever doc processing capabilities, enabling organizations to scan, learn, kind, extract, anonymize, convert, and confirm paperwork at scale.

By integrating superior OCR know-how, Klippa transforms unstructured information into structured codecs, facilitating seamless information administration and decreasing guide workloads. Dedicated to enhancing operational effectivity, Klippa’s options present instruments that empower companies to realize extra in much less time.

Who ought to use Klippa?

💡

Klippa is most fitted for small companies, particularly these in finance, retail, and logistics. Its cost-effective OCR and doc automation options add worth.

Options that matter

- Doc automation: Scans, reads, kinds, extracts, and verifies paperwork.

- Superior OCR: Extracts information precisely from numerous doc sorts.

- Knowledge anonymization: Masks delicate data for compliance.

- Doc verification: Validates authenticity to forestall fraud.

- Id verification: Analyzes paperwork and detects liveness for ID checks.

- API and SDK integrations: Seamlessly connects with current programs.

- Workflow automation: Creates customized processes to streamline duties.

Professionals and cons of Klippa

| Professionals | Cons |

|---|---|

| Correct OCR for information extraction | Restricted customization for templates |

| Intuitive and user-friendly interface | API documentation could possibly be improved |

| Responsive and immediate help | Occasional inaccuracies in OCR outcomes |

| Seamless integration with programs | Pricing could also be excessive for some options |

6. DEXT

Dext is a prime bookkeeping automation supplier. It helps companies, accountants, and bookkeepers seize, course of, and handle monetary paperwork effectively.

With seamless integration throughout main accounting software program and over 11,500 monetary establishments worldwide, Dext streamlines workflows by automating information extraction from receipts, invoices, and financial institution statements.

Its platform gives real-time expense monitoring, customizable approvals, and superior analytics for knowledgeable selections. By decreasing guide entry and errors, Dext boosts productiveness and lets professionals give attention to progress and consumer service.

Who ought to use DEXT?

💡

Dext is right for small to medium-sized companies, accountants, and bookkeepers in search of to automate information entry and streamline monetary workflows. Its options are notably useful for professionals aiming to reinforce effectivity and accuracy in monetary administration.

Options that matter

- Automated information seize: Collects receipts and invoices through cell, e mail, or integrations, eradicating guide entry.

- Seamless accounting integration: Syncs with main accounting software program and monetary establishments.

- Expense administration: Simplifies reporting and approvals for higher monetary management.

- Actual-time information processing: Immediately digitizes and categorizes monetary paperwork.

- Consumer-friendly interface: Intuitive design for straightforward navigation.

- Sturdy safety measures: Ensures information safety and compliance.

- Complete help: Offers in depth assets and help for customers.

Professionals and cons of Dext

| Professionals | Cons |

|---|---|

| Correct information extraction and processing | Superior options require technical experience |

| Seamless integration with accounting instruments | Pricing could also be excessive for small companies |

| Consumer-friendly and intuitive interface | Restricted cell app performance |

| Streamlines monetary workflows | Buyer help could possibly be improved |

| Sturdy safety and compliance | Lacks flexibility for area of interest integrations |

| Actual-time information processing | Some options have a studying curve |

7. Mindee

Mindee is an AI-powered platform that automates doc processing, changing unstructured information into actionable insights with over 90% accuracy. It handles a variety of paperwork, together with invoices, receipts, contracts, and IDs, processing tens of millions of information month-to-month.

With a user-friendly interface and superior resolution engines, Mindee accelerates workflows, reduces errors, and cuts prices by 30%+. Supporting many languages and zero-training fashions, it delivers fast outcomes.

Who ought to use Mindee?

💡

Mindee is greatest fitted to medium to massive enterprises and software program distributors the place superior doc processing is vital to optimizing operations and decreasing guide workflows.

Options that matter

- AI-powered information extraction: Precisely captures information from numerous paperwork, together with invoices, receipts, and IDs.

- Seamless integration: Simply integrates with current programs to streamline doc workflows.

- Customizable options: Provides tailor-made doc processing to satisfy particular enterprise wants.

- Open-source OCR toolkit: Offers docTR, an open-source OCR toolkit for versatile textual content recognition.

- Scalable platform: Handles massive volumes of paperwork effectively, appropriate for companies of all sizes.

- Consumer-friendly interface: Options an intuitive design for straightforward navigation and operation.

- Sturdy safety measures: Ensures information safety and compliance with business requirements.

- Complete documentation: Provides in depth assets and help for builders and customers.

Professionals and cons of Mindee

| Professionals | Cons |

|---|---|

| Correct information extraction | Superior options want experience |

| Seamless system integration | Restricted language help |

| Customizable for enterprise wants | Pricing particulars unclear |

| Scalable for top volumes | No cell app for on-the-go use |

| Consumer-friendly interface | Restricted buyer help particulars |

| Sturdy information safety | Further improvement for area of interest programs |

8. Google Cloud Imaginative and prescient API

Google Cloud Vision API permits builders to combine superior picture evaluation capabilities into their functions. It makes use of Google’s machine studying fashions to supply options equivalent to picture labeling, OCR, face and landmark detection, and express content material tagging.

The API helps a variety of picture codecs and might course of photos saved in numerous places, together with Google Cloud Storage and the online. Google Cloud Imaginative and prescient API simplifies the event course of, permitting companies to effectively derive actionable insights from visible information.

Who ought to use Google Cloud Imaginative and prescient API?

💡

Google Cloud Imaginative and prescient API is right for builders in search of to include superior picture evaluation into their functions with out in depth machine studying experience.

Options that matter

- Picture labeling: Identifies objects and entities in photos with descriptive labels.

- OCR: Extracts text from images, together with help for handwriting and a number of languages.

- Face detection: Detects human faces, recognizing feelings and facial landmarks.

- Landmark detection: Identifies well-known landmarks and gives geographic coordinates.

- Brand detection: Acknowledges model logos inside photos.

- Specific content material detection: Flags inappropriate or delicate content material for moderation.

- Picture properties evaluation: Analyzes picture attributes, together with dominant colours and composition.

- Object localization: Detects a number of objects in photos and gives bounding packing containers and labels.

Professionals and cons of Google Cloud Imaginative and prescient API

| Professionals | Cons |

|---|---|

| Excessive accuracy in picture recognition | Premium pricing for high-volume utilization |

| Straightforward integration with current functions | Restricted customization for particular use instances |

| Helps a number of languages for textual content extraction | Occasional inaccuracies with low-quality photos |

| Complete documentation and help assets | Requires web connectivity for API entry |

| Sturdy options embody OCR, face detection, and object localization | Studying curve for customers with out prior expertise |

About Veryfi

Veryfi addresses effectivity in information processing by providing superior OCR know-how that transforms unstructured paperwork into structured, actionable information. The AI-powered resolution automates the extraction of data from invoices, receipts, checks, and extra, enabling seamless integration into numerous functions.

💡

Small accounting companies and bookkeepers desire Veryfi for its user-friendly cell app and environment friendly API setup.

Options that matter

- AI-powered OCR: Mechanically extracts information from receipts and invoices with excessive precision.

- Actual-time processing: Offers immediate entry to structured information.

- International compatibility: Helps 90+ currencies and 39 languages.

- Safe compliance: Meets SOC 2, GDPR, and HIPAA requirements.

- Seamless integrations: Connects with instruments like QuickBooks and Xero.

- Cellular seize: Permits high-quality information seize through smartphones.

- Developer APIs: Provides APIs and SDKs for straightforward system integration.

- Expense administration: Consumer-friendly app for monitoring bills on the go

Professionals and cons of Veryfi

| Professionals | Cons |

|---|---|

| Quick and correct OCR | Costly for small companies |

| Intuitive interface | Occasional OCR errors |

| Works effectively with accounting instruments | Delays in buyer help |

| Handle bills on the go | Superior options solely in greater plans |

Why select Nanonets AI over Veryfi?

Nanonets stands out with its superior AI capabilities, superior customizability, and broader help for numerous doc sorts. Whereas this would possibly seem to be a common assertion, there are a number of particular the explanation why many customers desire Nanonets’ superior AI-enabled OCR.

💡

– M. Aflah PT, Solusi Aplikasi (Indonesia)

Some arguments in favor of Nanonets

Named by G2 as a global OCR leader, Nanonets gives distinctive OCR accuracy, buyer help, and workflow automation efficiency. Nanonets additionally stands out because the trusted alternative of Fortune 500 corporations worldwide.

- Its sturdy AI engine stands out, with a 95%+ discipline and line merchandise extraction accuracy whereas studying to exactly deal with numerous use instances and constantly bettering.

- Its enhanced software program interoperability reduces setup time, and it comes with built-in 30+ integration choices with all main ERP and accounting instruments (Xero, Quickbooks On-line, Sage, Oracle Netsuite, and so on.).

- Nanonets processes information in seconds, presenting information in customizable checklist views and a number of export choices with rule-based alerts for speedy consideration and verification.

- With a quick implementation, consideration to every buyer’s distinctive wants for personalization, and efficient buyer help, Nanonets stands out as vital in your tech stack.

Nanonets vs Veryfi OCR

| Metric | Nanonets | Veryfi |

|---|---|---|

| Integration Assist | Intensive | Restricted |

| Language Assist | 100+ | Restricted |

| Customization | Excessive | Reasonable |

| AI Mannequin Coaching | Sure (with AI confidence scores) | No |

| On-Premise Deployment | Accessible | Not Accessible |

| Devoted Account Supervisor | Sure | No |

| White-Labeled UI | Sure | No |

| Doc use instances | 300+ paperwork | Receipts and bills majorly |

| OCR information seize | 95%+ accuracy with AI | …. |

Ceaselessly Requested Questions (FAQs) about Veryfi

Veryfi automates monetary doc processing utilizing superior OCR. It extracts information from receipts and invoices, integrates with accounting software program, and gives real-time expense monitoring to remove guide information entry.

What are some widespread alternate options to Veryfi?

Options to Veryfi embody Nanonets, Klippa, Xero Hubdoc, Google Cloud Imaginative and prescient API, ABBYY, and Dext. These instruments supply options like superior OCR, expense monitoring, and integration with accounting programs.

Which Veryfi various is greatest for small companies?

Zoho Expense and Dext are nice for small companies resulting from their ease of use, inexpensive pricing, and adaptability in managing bills and invoices.

How does Nanonets evaluate to Veryfi?

Nanonets excels with its AI-driven OCR, multi-language help, and the power to course of unstructured information, making it extra versatile than Veryfi.

Are Veryfi alternate options straightforward to combine with accounting software?

Sure, most alternate options, equivalent to Klippa, Xero Hubdoc, and Nanonets, present seamless integration with CRMs, accounting instruments, and APIs, guaranteeing easy workflows.

Veryfi vs. Hubdoc vs. DEXT: Who is best?

Select based mostly in your particular enterprise wants:

- Veryfi: Greatest for fast, automated information extraction.

- Hubdoc: Superb for Xero and QuickBooks customers.

- DEXT: Complete for detailed expense administration.