Getty

GettyThe value of Bitcoin has for the primary time damaged previous the $100,000 mark, hitting a brand new document excessive.

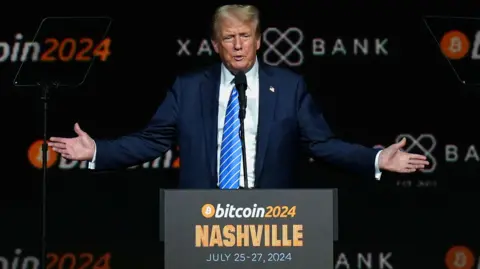

The worth of the world’s largest cryptocurrency has been boosted by hopes US President-elect Donald Trump will undertake crypto-friendly insurance policies.

The milestone was reached hours after Trump mentioned he would nominate former Securities and Change Fee (SEC) commissioner Paul Atkins to run the Wall Road regulator.

Mr Atkins is seen as being way more pro-cryptocurrency than the present head of the SEC, Gary Gensler.

The $100,000 milestone prompted celebrations from cryptocurrency followers all over the world.

Bitcoin’s wildly fluctuating worth has all the time attracted curiosity, with its backers reacting with delight when it has passed previous price thresholds – and defiance during its slumps.

However this explicit landmark has been particularly keenly anticipated. For weeks charts, memes and predictions have swirled round social media about when the value would hit the determine considered one of many holy grails of the crypto world.

Thousands and thousands of viewers even tuned in to on-line watch events as the value hovered near $100k.

The worth of a single bitcoin is among the barometers of optimism within the cryptocurrency trade which is now estimated to be value $3.3tn, based on evaluation agency Coin Market Cap.

Trump’s election victory final month was the catalyst for the most recent surge.

The president-elect has vowed to make the US “the crypto capital of the planet” – a exceptional turnaround given as just lately as 2021 he was calling Bitcoin a “rip-off.”

Additionally exceptional is simply how Bitcoin’s value has rocketed. A valuation of $100k represents a 40% enhance on election day within the U.S. and greater than double the value it began the yr at.

Reuters

ReutersHowever there’s tons extra to Bitcoin than the dizzying modifications in its worth.

From its enigmatic inventor to the bringing down of the so-called Crypto King, it is a story with many twists and turns, which has seen the making – and shedding – of big fortunes.

So here is the BBC’s record of the seven wildest moments – to date – in Bitcoin’s tumultuous historical past.

1. The mysterious creator of Bitcoin

Regardless of its monumental profile, no-one truly is aware of for certain who invented Bitcoin. The concept for it was posted on web boards in 2008 by somebody calling themselves Satoshi Nakamoto.

They defined how a peer-to-peer digital money system may work to allow individuals to ship digital cash over the web, simply as simply as sending an electronic mail.

Satoshi created a fancy laptop system that might course of transactions and create new cash utilizing an enormous community of self-appointed volunteers all over the world who used particular software program and highly effective computer systems.

However he – or they – by no means revealed their id, and the world has by no means labored it out.

Reteurs

ReteursIn 2014, Japanese-American man Dorian Nakamoto was pursued by reporters who thought he was the elusive Bitcoin creator, however it proved to be a false lead brought on by some mistranslated info.

Australian laptop scientist Craig Wright mentioned it was him in 2016 – however after years of authorized battles, a Excessive Courtroom decide concluded he was not Satoshi.

Earlier this yr, a Canadian Bitcoin knowledgeable referred to as Peter Todd strongly denied being Satoshi, whereas in London this month a British man, Stephen Mollah, claimed he was – but no-one believed him.

2. Making historical past… with pizza

Bitcoin now underpins a two trillion-dollar cryptocurrency trade – however the first recorded transaction utilizing it was the acquisition of pizza.

On 22 Could 2010, Lazlo Hanyecz, supplied $41 value of Bitcoin on a crypto discussion board in return for 2 pizzas.

A 19-year-old scholar obliged and the day went down in historical past for followers of the foreign money as #BitcoinPizza day.

A supply of memes for these in crypto neighborhood, it additionally showcased the facility of Bitcoin – an web cash that might genuinely purchase objects on-line.

Criminals should have been watching too, as a result of inside a yr the primary darknet market was launched promoting medicine and different unlawful items in alternate for Bitcoin.

The deal appears fairly unhealthy for Lazlo now too. If he had held onto these cash they’d now be value a whole bunch of thousands and thousands of {dollars}!

3. Turning into authorized tender

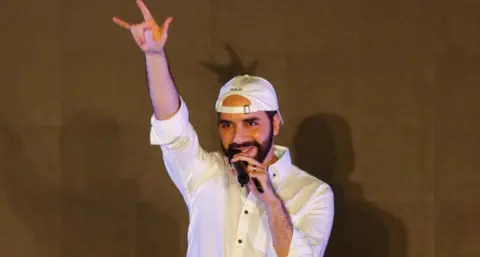

In September 2021, President Nayib Bukele of El Salvador, central America, made Bitcoin authorized tender.

Hairdressers, supermarkets and different outlets needed to settle for Bitcoin by legislation, alongside its most important foreign money, the US greenback.

Many Bitcoin fanatics and reporters visited the world, briefly boosting tourism to the nation.

Whereas President Bukele hoped the transfer would enhance funding in his nation and lower prices for residents exchanging cash, it didn’t develop into as in style as he hoped.

He’s nonetheless hoping it should take off however for now the US greenback nonetheless stays king within the nation.

Reuters

ReutersIn addition to the massive quantity of public cash President Bukele spent on making an attempt to make individuals embrace Bitcoin he additionally, controversially, purchased greater than 6,000 bitcoins over the previous few years.

The president spent not less than $120m shopping for up bitcoins at numerous costs within the hope of creating a revenue for his cash-strapped nation.

It started to look good for him in December 2023 when, for the primary time, his stash skyrocketed in worth.

A web site constructed by Dutch software program engineer Elias Zerrouq is tracking the country’s Bitcoin holdings and presently estimates that the cash have risen 98% in worth.

4. Kazakhstan’s crypto growth and bust

In 2021, Kazakhstan turned a hotspot for Bitcoin mining – the method of crunching by the advanced calculations that underpin crypto transactions.

As of late it takes warehouses stuffed with the most recent computer systems working all day and all evening, however the reward is model new bitcoins for these firms that participate.

Warehouses of computer systems require a lot of energy – and lots of companies moved to Kazakhstan the place electrical energy was plentiful thanks to large coal reserves.

At first the federal government welcomed them with open arms as they introduced funding.

However too many miners arrived and put big pressure on the electrical energy grid, placing the nation liable to blackouts.

Inside a yr, Kazakhstan’s Bitcoin mining trade went from boom to bust as the federal government imposed restrictions and elevated taxes to curb the expansion.

All over the world it’s estimated that the Bitcoin community makes use of as a lot electrical energy as a small nation, elevating considerations about its environmental affect.

5. Bitcoins within the garbage dump

Think about having a crypto pockets value greater than $100m (£78m) – after which accidentally throwing away a tough drive containing the login particulars.

That is what James Howells, from south Wales, says occurred to him

The very nature of crypto implies that restoration shouldn’t be as straightforward as resetting your password. With no banks concerned – there isn’t a buyer assist helpline.

James Howells

James HowellsSadly for him, his native council in Newport refused to let him entry the landfill website the place he says the gadget ended up – even after he supplied to donate 25% of his Bitcoin stash to native charities in the event that they let him.

He instructed the BBC: “It was a penny dropping second and it was a sinking feeling.”

6. Crypto King fraudster

No-one has misplaced as a lot Bitcoin as former billionaire crypto mogul, Sam Bankman-Fried. The founding father of the large crypto agency FTX was nicknamed the Crypto King and liked by the neighborhood.

FTX was a cryptocurrency alternate that allowed individuals to commerce regular cash for cryptocurrencies like Bitcoin.

reuters

reutersHis empire was value an estimated $32bn and he was flying excessive till every thing got here crashing down inside days.

Journalists had found that Bankman-Fried’s firm was financially shaky and had been illegally transferring FTX buyer funds to prop up his different firm, Alameda Analysis.

Simply earlier than his arrest at his luxurious house advanced within the Bahamas in December 2022 he spoke to reporters. He told the BBC: “I do not suppose I dedicated fraud. I did not need any of this to occur. I used to be actually not almost as competent as I assumed I used to be.”

After being extradited to the US he was discovered responsible of fraud and cash laundering and was jailed for 25 years.

7. Funding financial institution growth

Regardless of all of the turmoil, Bitcoin continues to draw consideration from buyers and massive firms.

Actually, in January 2024, a few of the largest monetary companies on this planet added Bitcoin to their official asset lists as Spot Bitcoin ETFs. These are like shares and shares, linked to the worth of Bitcoin however you do not have to personally personal any.

Prospects have been pouring billions into these model new merchandise. Firms together with Blackrock, Constancy and GrayScale, have additionally been buying up Bitcoins in their thousands, pushing up its worth to document highs.

It’s a big milestone for crypto with some followers believing that Bitcoin is lastly being taken as critically because the mysterious Satoshi imagined.

Nonetheless, few would again in opposition to extra wild moments because the Bitcoin story continues to unfold.