Worldwide Enterprise Correspondent

BBC

BBCTheo will probably be responding to reader feedback about this text between 12pm and 1pm right now. Go to the feedback part on the backside of this web page to share what you consider the rise of those extra reasonably priced EVs.

In China, they name it the Seagull, and it has seems to be to match. It’s glossy and angular, with shiny, downward-slanting headlights which have greater than a touch of mischievous eyes about them.

It’s, in fact, a automobile. A really small one, designed as an affordable metropolis runabout – but it surely might have enormous significance. Accessible in China since 2023, the place it has proved extraordinarily widespread, it has simply been launched in Europe with the title Dolphin Surf (as a result of Europeans apparently aren’t as eager on seagulls as Chinese language individuals).

When it goes on sale within the UK this week, it is anticipated to have a price ticket of round £18,000. That can nonetheless make it, for an electrical automobile on western markets, very low cost certainly.

It will not be the outright lowest-priced mannequin on supply: the Dacia Spring, manufactured in Wuhan collectively by Renault and Dongfeng, and the Leapmotor T03, which is being produced by a three way partnership between Chinese language startup Leapmotor and Stellantis, each value much less.

However the Dolphin Surf is the invasive species that has long-established manufacturers most apprehensive. That’s as a result of the corporate behind it has been making ever larger waves on worldwide markets.

Bloomberg through Getty

Bloomberg through GettyBYD is already the most important participant in China. It overtook Tesla in 2024 to turn into the world’s best-selling maker of electrical autos (EVs), and since getting into the European markets two years in the past, it has expanded aggressively.

“We need to be primary within the British market inside 10 years,” says Steve Beattie, gross sales and advertising and marketing director for BYD UK.

BYD is a part of a wider growth of Chinese language firms and types that some consider might change the face of the worldwide motor trade – and which has already prompted radical motion from the US authorities and the EU.

It means once-unknown marques like Nio, Xpeng, Zeekr or Omoda might turn into each bit as a lot family names as Ford or Volkswagen. They are going to be part of traditional manufacturers corresponding to MG, Volvo and Lotus, which have been beneath Chinese language possession for years.

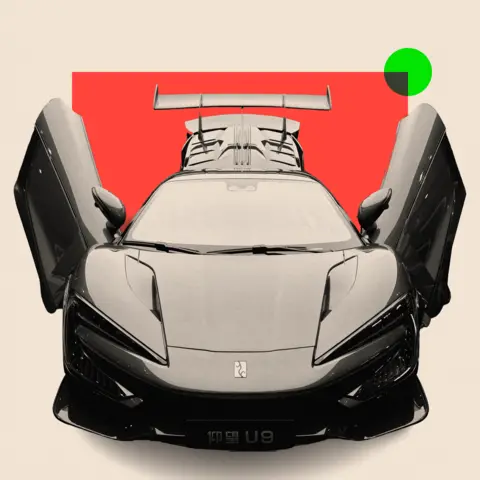

The merchandise on supply already embody an enormous vary, from runabouts just like the tiny Dolphin Surf to unique supercars, just like the pothole-jumping U9, from BYD’s high-end sub-brand Yangwang.

“Chinese language manufacturers are making huge inroads into the European market,” says David Bailey, professor of enterprise and economics at Birmingham Enterprise College.

In 2024, 17 million battery and plug-in hybrid vehicles have been bought worldwide, 11 million of these in China. Chinese language manufacturers, in the meantime, had 10% of worldwide EV and plug-in hybrid gross sales exterior their dwelling nation, in response to the consultancy Rho Movement. That determine is barely anticipated to develop.

For shoppers, it ought to be excellent news – resulting in extra high-quality and reasonably priced electrical vehicles turning into out there. However with rivalry between Beijing and western powers displaying no signal of subsiding, some consultants are involved Chinese language autos might symbolize a safety threat from hackers and third events. And for established gamers in Europe, it represents a formidable problem to their historic dominance.

“[China has] an enormous value benefit via economies of scale and battery expertise. European producers have fallen effectively behind,” warns Mr Bailey.

“Until they get up in a short time and catch up, they could possibly be worn out.”

Reduce-throat competitors in China

China’s automobile trade has been creating quickly because the nation joined the World Commerce Organisation in 2001. However that course of accelerated quickly in 2015, when the Communist Social gathering launched its “Made in China 2025” initiative. The ten-year plan to make the nation a frontrunner in a number of high-tech industries, together with EVs, attracted intense criticism from overseas, and significantly the US, amid claims of compelled expertise transfers and theft of mental property – all of which the Chinese language authorities denies.

Fuelled by lavish state funding, the plan helped lay the groundwork for the breakneck progress of firms like BYD – initially a maker of batteries for cell phones – and allowed the Chinese language dad or mum firms of MG and Volvo, SAIC and Geely, to turn into main gamers within the EV market.

“The overall customary of Chinese language vehicles could be very, very excessive certainly,” says Dan Caesar, chief govt of Electrical Autos UK.

“China has discovered extraordinarily rapidly find out how to manufacture vehicles.”

But competitors in China has turn into ever extra cut-throat, with manufacturers jostling for area in an more and more saturated market. This has led them to hunt for gross sales elsewhere.

Whereas Chinese language corporations have expanded into East Asia and South America, for years the European market proved a troublesome nut to crack – that’s, till governments right here determined to section out the sale of recent petrol and diesel fashions.

The transition to electrical vehicles opened the door to new gamers.

“[Chinese brands] have seen a possibility to get a little bit of a foothold,” says Oliver Lowe, UK product supervisor of Omoda and Jaecoo, two sub manufacturers of the Chinese language big Chery.

STR through Getty

STR through GettyLow labour prices in China, coupled with authorities subsidies and a really well-established provide chain, have given Chinese language corporations benefits, their rivals have claimed. A report from the Swiss financial institution UBS, revealed in late 2023, recommended that BYD alone was in a position to construct vehicles 25% extra cheaply than western opponents.

Chinese language corporations deny the taking part in subject is uneven. Xpeng’s vice chairman Brian Gu instructed the BBC on the Paris Motor Present in 2024 that his firm is aggressive “as a result of we’ve fought tooth and nail via probably the most aggressive market on this planet”.

‘Bare protectionism’ from the US?

Issues that Chinese language EV imports might flood worldwide markets on the expense of established producers reached fever pitch in 2024.

Within the US, the Alliance for American Manufacturing warned they might show to be an “extinction-level occasion” for the US trade, whereas the European Fee president Ursula von der Leyen recommended that “enormous state subsidies” for Chinese language corporations have been distorting the European market.

The Biden administration took dramatic motion, elevating import tariffs on Chinese language-made EVs from 25% to 100%, successfully making it pointless to promote them within the US.

It was condemned by Beijing as “bare protectionism”.

REUTERS/Leah Millis

REUTERS/Leah MillisIn the meantime, in October 2024, the EU imposed additional tariffs of as much as 35.3% on Chinese language-made EVs. The UK, nonetheless, took no motion.

Matthias Schmidt, founding father of Schmidt Automotive Analysis, says the EU’s tariffs have now made it more durable for Chinese language corporations to realize market share.

“The door was vast open in 2024… however the Chinese language did not take their likelihood. With the tariffs in place, Chinese language producers are actually unable to push their value benefit onto European shoppers.”

Renault’s ultra-modern EV hub

European producers have been racing to develop their very own reasonably priced electrical vehicles. French car-maker Renault is amongst them.

At its manufacturing facility in Douai, in northeastern France, a military of spark-spitting robots weld sections of metal to kind automobile our bodies, whereas on the primary meeting line, automated programs mate collectively bodyshells, doorways, batteries, motors and different components, earlier than human employees apply the ending touches.

The manufacturing facility has been making vehicles for Renault since 1974, however 4 years in the past, the ageing manufacturing traces have been changed with new extremely automated, digitally-controlled programs.

A part of the location was additionally taken over by the Chinese language-owned battery agency AESC, which constructed its personal “gigafactory” subsequent door.

Renault

RenaultIt is a part of Renault’s wider plan to arrange an ultra-modern EV “hub” in northern France. Mirroring the lean manufacturing strategies of Chinese language producers, the hub cuts prices by maximising effectivity and guaranteeing that suppliers are positioned as shut as potential.

“Our goal was to have the ability to produce reasonably priced electrical vehicles right here to promote in Europe,” explains Pierre Andrieux, director of the Douai plant, arguing that automated processes “will allow us to try this profitably”.

However the firm can also be exploiting one thing the Chinese language manufacturers do not need: heritage. Its newest mannequin, the Renault 5 E-tech, in-built Douai, borrows its title from one of many firm’s most well-known merchandise.

Getty Pictures and Renault

Getty Pictures and RenaultThe unique Renault 5, launched in 1972, was a unusual little everyman automobile with boxy seems to be and low working prices that turned a cult traditional.

The brand new design, regardless of being a state-of-the artwork EV, pays homage to its predecessor in title and look, in an effort to emulate its widespread enchantment.

Safety, spy ware and hacking issues

However no matter how fascinating Chinese language vehicles are as compared with European rivals, some consultants consider we ought to be cautious of them – for safety causes.

Most fashionable autos are internet-enabled not directly – to permit satellite tv for pc navigation, for instance – and drivers’ telephones are sometimes related to automobile programs. Pioneered by Tesla, so-called “over-the-air updates” can improve a automobile’s software program remotely.

This has all led to issues, in some quarters, that vehicles could possibly be hacked and used to harbour spy ware, monitor people and even be immobilised on the contact of a keyboard.

Getty Pictures

Getty PicturesEarlier this 12 months, a British newspaper reported that navy and intelligence chiefs had been ordered to not talk about official enterprise whereas using in EVs; it was additionally alleged that vehicles with Chinese language elements had been banned from delicate navy websites.

Then in Could, a former head of the intelligence service MI6 claimed that Chinese language-made expertise in a variety of merchandise, together with vehicles, could possibly be managed and programmed remotely. Sir Richard Dearlove warned MPs that there was the potential to “immobilise London”.

Beijing has at all times denied all accusations of espionage.

A spokesperson for the Chinese language embassy in London says that the latest allegations are “fully unfounded and absurd”.

“China has persistently advocated the safe, open, and rules-based growth of worldwide provide chains,” the spokesperson instructed the BBC. “Chinese language enterprises working world wide are required to adjust to native legal guidelines and laws.

“So far, there isn’t a credible proof to help the declare that Chinese language EVs pose a safety menace to the UK or another nation.”

Chinese language authorities is ‘not hell-bent on surveillance’

Joseph Jarnecki, analysis fellow at defence and safety think-tank The Royal United Providers Institute, argues that potential dangers could be mitigated.

“Chinese language carmakers exist on this extremely aggressive market. Whereas they’re beholden to Chinese language legislation and that will require compliance with nationwide safety companies, none of them need to harm their means to develop and to have worldwide exports by being perceived as a safety threat,” he says.

“The Chinese language authorities equally is acutely aware of the necessity for financial progress. They don’t seem to be hell-bent on solely conducting surveillance.”

However the automobile trade is only one space during which Chinese language expertise is turning into more and more enmeshed within the UK financial system. To attain the federal government’s local weather targets, for example, “It is going to be vital to make use of Chinese language-supplied expertise”, provides Mr Jarnecki.

He believes that regulators of key industries ought to be given adequate assets to watch cyber safety and advise firms utilizing Chinese language merchandise of any potential points.

As for electrical vehicles powered by Chinese language expertise, there is not any query that they are right here to remain.

“Even if in case you have a automobile that is made in Germany or elsewhere, it in all probability accommodates fairly just a few Chinese language elements,” says Dan Caesar.

“The truth is most of us have smartphones and issues from China, from the US, from Korea, with out actually giving it a second thought. So I do suppose there’s some fearmongering happening about what the Chinese language are able to.

“I believe we’ve to face the fact that China goes to be an enormous a part of the longer term.”

High picture credit score: Reuters

BBC InDepth is the brand new dwelling on the web site and app for one of the best evaluation and experience from our high journalists. Underneath a particular new model, we’ll deliver you recent views that problem assumptions, and deep reporting on the most important points that can assist you make sense of a fancy world. And we’ll be showcasing thought-provoking content material from throughout BBC Sounds and iPlayer too. We’re beginning small however considering large, and we need to know what you suppose – you’ll be able to ship us your suggestions by clicking on the button under.