Bank card fraud prices the worldwide financial system billions yearly. Companies want machine studying fashions that detect fraud earlier than it occurs. However fraud detection is without doubt one of the hardest challenges in knowledge science:

- Fraud is uncommon, lower than 1 in 500 transactions.

- Patterns change consistently — fraudsters adapt.

- Errors are costly — false positives frustrate prospects; false negatives lose cash.

A mannequin that performs effectively immediately may fail silently tomorrow. That’s why it’s not sufficient to coach a superb mannequin. You additionally have to monitor drift — delicate shifts in knowledge that slowly degrade mannequin accuracy.

On this article, I’ll present the best way to construct a full machine studying pipeline for fraud detection:

- Deal with extreme class imbalance.

- Practice a strong mannequin.

- Consider accurately

- Monitor drift so your mannequin doesn’t decay in silence.

We’ll use the well-known Kaggle Credit Card Fraud Detection dataset. Let’s get began.

Let’s first perceive the stakes.

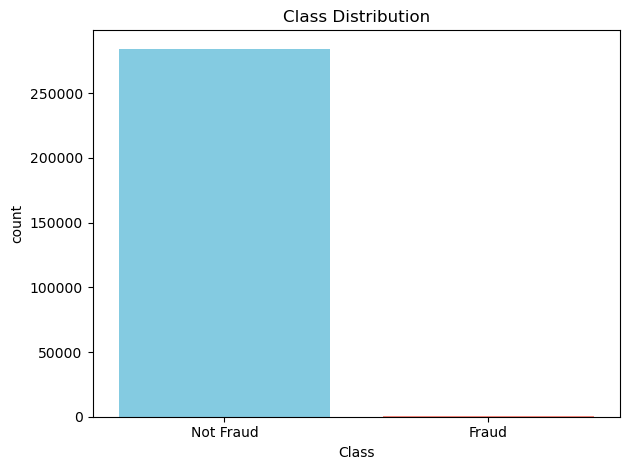

Within the Kaggle dataset:

- There are 284,807 transactions.

- Solely 492 are frauds (~0.17%).