Farid Soroush, Ph.D.

Machine Studying, AI

E-mail: soroushfarid@gmail.com

[GitHub Repository Link]

Alpha indicators, broadly outlined as indicators of extra returns, are sometimes obscured by noise and complicated relationships amongst property. Conventional strategies rely closely on engineered options or statistical correlations; this work as a substitute evaluates the power of Graph Neural Networks (GNNs) to extract an artificial alpha sample that relies upon solely on the graph construction.

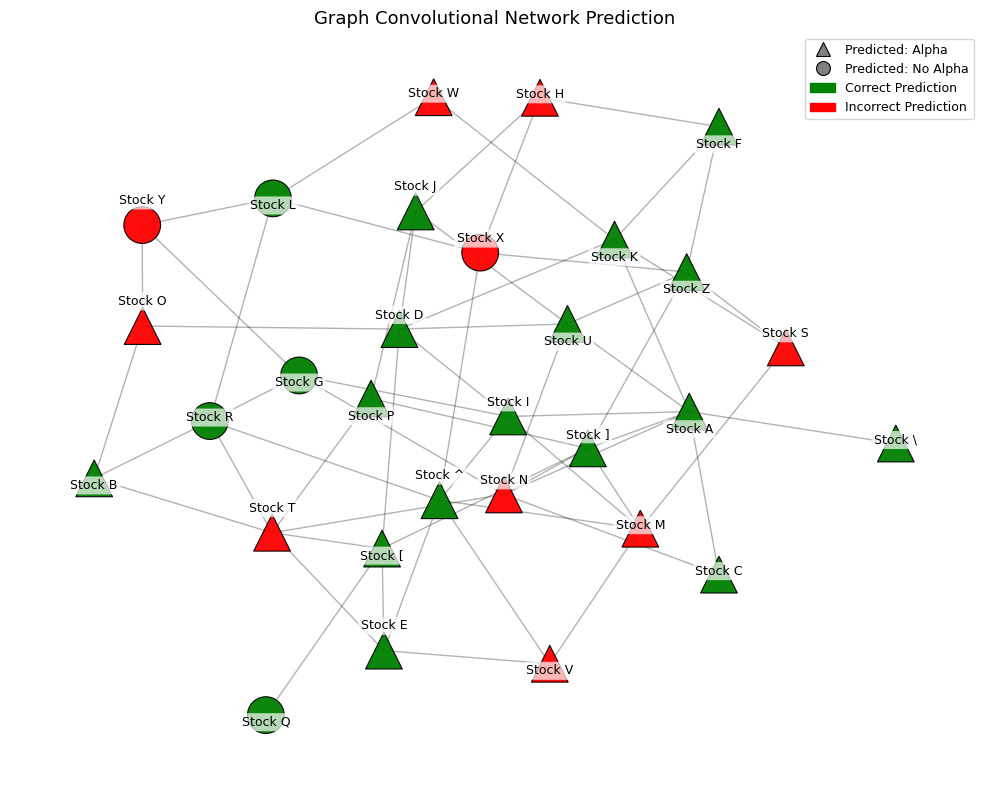

An artificial inventory community is constructed the place every node represents a inventory, and connections symbolize arbitrary relationships (e.g., co-movements or sector similarity). Every node is assigned a function vector consisting of noisy values simulating generic monetary indicators. The binary classification label — whether or not a inventory has alpha — is decided by a structural rule: a node is labeled constructive (alpha = 1) whether it is linked to precisely one different node whose index is divisible by 7. This rule is designed to create a weak sign that can’t be inferred from native node options alone.

A two-layer Graph Convolutional Community (GCN) is educated on this graph to foretell the alpha label. Regardless of the absence of specific info within the options, the GCN achieves a classification accuracy of roughly 66.67%, indicating its means to study the underlying structural rule.