Have you ever ever puzzled if AI crypto buying and selling bots really work—or in the event that they’re simply smoke and mirrors?

I spent weeks testing eleven platforms—some technique engines, others alert bridges—all hooked to Coinbase Professional or Binance through API. I needed to see how they carry out in actual buying and selling circumstances. What stood out, what flopped, and which bot may match precisely what you’re in search of? Let’s dig in.

Why Use an AI Crypto Buying and selling Bot?

These bots can work across the clock, zap emotion out of your buying and selling, backtest methods, and even execute trades primarily based on advanced guidelines. However the catch is choosing one that matches your buying and selling type—whether or not you’re a hands-off investor or a method builder.

How I Examined Them

- Related every instrument through API/webhook to a take a look at alternate account

- Ran dwell methods or alerts with small capital

- Centered on usability, technique flexibility, backtest instruments, and help

- In contrast what every bot has versus what it guarantees to ship

⬇️ See the top AI Crypto bots

What Actually Issues in a Good AI Bot

- Technique Sorts: Grid, DCA, pattern following, sample recognition

- Execution: Native buying and selling API vs alert/webhook pathways

- Ease of Use: setup complexity, interface move

- Transparency: backtests, threat information, drawdowns

- Price & Worth: free trial, pricing tiers, entry to options

Greatest Crypto Buying and selling Bot: Right here is What I Discovered

- Aterna AI

- Tickeron

- Intellectia

- Coinrule

- TradeIdeas

- TradingView

- TradeSanta

- Kavout

- Signal Stack

- Bitsgap

Core Options

- Fingers-off execution

- AI-driven sample detection

- Dynamic threat sizing

- Claims ~4.3% month-to-month return with <4% max drawdown primarily based on verified 2024 outcomes.

Greatest For

Busy professionals who need passive automation with out fixed monitoring.

My Take

Setup was seamless, trades executed with out fuss. Outcomes felt lifelike—however public transparency is gentle. Promising, however belief builds over time.

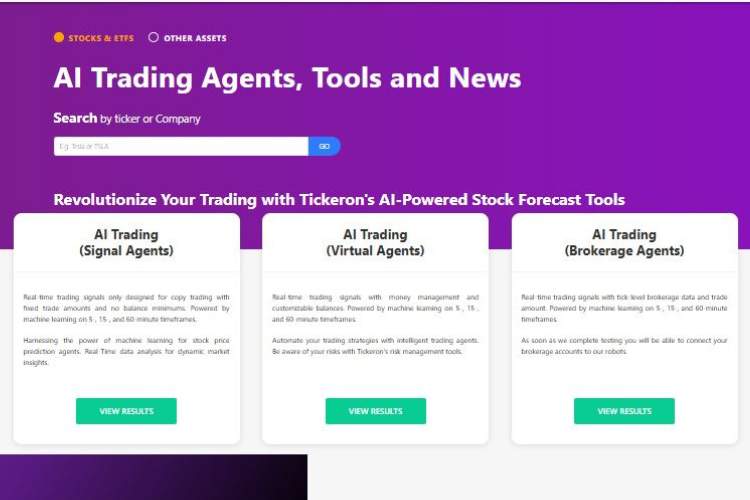

Core Options

- Single‑ticker ML brokers

- Candlestick sample detection

- Backtests

- Prebuilt Day Dealer” or “Momentum” bots

Greatest For

Merchants who need centered AI indicators on one asset like BTC or SOL.

My Take

Plug-and-play straightforward. You can begin a NVDA agent and let it run. Limitations current if you need multi-coin methods or customized configuration.

Core Options

- Swing-trade indicators primarily based on sentiment, fundamentals, XGBoost/ML

- InvestGPT chat interface

- Multi-coin evaluation

Greatest For:

Knowledge-driven merchants preferring insight-led resolution making fairly than full automation.

My Take

Alerts are nuanced and useful. API execution is absent—alerts result in guide or webhook-injected trades. Nonetheless, it guided my timing and sizing effectively.

Core Options

- Rule-based IF–THEN builder

- Technique market

- Backtesting

- Change integration together with Coinbase and Binance

Greatest For

Merchants who need no-code automation throughout a number of exchanges with templates and suppleness.

My Take

Constructing a method (e.g. RSI‑cross DCA) on the fly felt intuitive. Connecting and executing actual trades was clear and quick.

Core Options

- Holly AI engine

- OddsMaker backtesting

- TradeWave momentum module, alert-driven commerce indicators

Greatest For

Aadvanced swing/day merchants searching for deep sign scanning plus standalone execution through webhook integrations.

My Take

Market scans are intense, indicators sharp—however there’s a steep studying curve. It delivers energy when you grasp it.

Core Options

- Customized Pine Script technique builder

- Alerts

- Charting

- Neighborhood script market

- Execution through connectors (e.g. WunderTrading)

Greatest For

DIY merchants constructing bespoke methods who need full flexibility with alert-triggered execution.

My Take

Very highly effective for those who’re snug scripting. Technique tuning takes effort. Works amazingly effectively when paired with execution bridge instruments.

Core Options

- Cloud bots supporting DCA, GRID, futures

- Binance and alternate auto-connect, templates, trailing take-profit

Greatest For

Customers craving easy, dependable bot automation with template methods.

My Take

Setup was almost foolproof. Templates run effectively and have stability—nice possibility if coding isn’t your factor.

Core Options

- Kai Rating

- Sensible Alerts throughout crypto & shares

- Pure language InvestGPT chat

- Portfolio diagnostics

Greatest For

Merchants prioritizing sign insights over automation.

My Take

Alerts are polished and disciplined. No commerce execution from the platform—however sign high quality robust for decision-making.

Core Options

Converts alerts from TradingView, TrendSpider, and so on., into automated trades executed in ~0.5s throughout exchanges and brokers

Greatest For

Merchants who construct alerts and need zero-latency execution.

My Take

Lean and reliable. Seems like automation glue—good for those who’re busy coding alerts and simply want execution sorted.

Core Options

- Multi-exchange help

- Grid, DCA, combo bots, portfolio monitoring and backtest instruments—however crypto solely, no shares

Greatest For

Critical crypto multi-coin portfolio managers.

My Take

Glorious for crypto merchants utilizing a number of exchanges. However not relevant for inventory customers.

Comparability Desk

| Instrument | Greatest For | Technique Type | Automation Sort | Ease of Use |

| Aterna AI | Fingers-off pattern followers | AI-pattern, set & neglect | Full native exec | Very straightforward |

| Tickeron | Single-coin sample bots | ML brokers (candlesticks) | Full exec through personal system | Straightforward |

| Intellectia | Insightful swing indicators | Sentiment & tech ML | Alerts/w Optionally webhook | Reasonable |

| Coinrule | No-code rule automation | IF–THEN rule templates | Native alternate bots | Newbie-friendly |

| TradeIdeas | Superior sign scanners | AI scan alerts | Alerts -> exterior exec | Energy-user complexity |

| TradingView | Customized technique builders | Pine Script customized | Alert webhooks through connector | Superior setup |

| TradeSanta | Dependable template bots | Grid, DCA, futures | Native automation | Very user-friendly |

| Kavout | Sign-based evaluation | Scoring indicators | Alerts/guide | Perception-focused |

| Sign Stack | Alert execution bridge | Any alert logic | Webhook commerce execution | Lean and dependable |

| Bitsgap | Multi-exchange crypto bots | Grid, DCA, combo | Native alternate automation | Crypto-focused usability |

Conclusion & Prime 3 Suggestions

My high picks primarily based on actual testing:

1. Coinrule – For versatile, no-code automation throughout exchanges. Greatest mixture of usability and efficiency.

2. TradeSanta – If you’d like reliable grid/DCA/futures bots operating on autopilot. Little friction, dependable execution.

3. Signal Stack – Ultimate for these with customized sign programs who simply need quick, painless execution. Retains the complexity in technique, not plumbing.

Different instruments shine too:

- Intellectia is gold for those who worth perception over automation

- Tickeron is helpful for single-asset focus

- TradeIdeas is unmatched in scanning depth as soon as it’s dialed in

Should you’re new—begin with Coinrule or TradeSanta. Should you’re customizing methods—use TradingView + Sign Stack. If you’d like signal-driven perception—Intellectia matches finest. Select primarily based on how a lot you need code vs templates, management vs autopilot, and perception vs execution.