Buyer churn happens when a buyer discontinues utilizing an organization’s services or products or cancels their contracts or subscriptions. Most corporations attempt to retain their present clients as a result of it’s usually inexpensive to retain a buyer than to accumulate a brand new one.

A buyer churn prediction mannequin, also referred to as a churn mannequin, estimates the probability {that a} buyer will cease being a buyer. Churn fashions are a reasonably frequent sort of predictive challenge that includes advanced knowledge buildings, refined machine studying algorithms, and a robust understanding of the enterprise that’s trying to make use of these predictions.

Constructing a churn mannequin doesn’t begin with knowledge. It begins with understanding what sort of downside you might be actually tasked with fixing and the way any insights could also be utilized by the enterprise.

In idea, lowering churn has a easy three step resolution:

- Create product

- Deal with all of your clients with respect

- Worth the services and products competitively

You don’t want a predictive mannequin for this and also you don’t even want a lot — if any — knowledge science.

The place you want knowledge science, is to assist discover methods to do these three issues in a price‑efficient method:

- What’s the minimal price to develop a product that’s “ok”?

- Which clients are you able to safely ignore and which of them want further consideration?

- Which clients are you able to cost the next value?

That is clearly the intense reverse finish of the spectrum, and this isn’t to say that any of the businesses or organizations that I’ve labored with would essentially consider it on this means. Nevertheless, it may be useful for the info scientist to grasp this in order that we are able to information the info assortment, function engineering, and mannequin choice within the path that gives one of the best help to the precise goal.

There may be a number of data out there on the best way to write the Python or R code to coach a mannequin of any form, however much less data on all of the work that should occur earlier than you can begin gathering knowledge and writing code. This text makes an attempt to bridge that hole whereas specializing in churn prevention.

Step one in constructing a churn mannequin is to debate with the enterprise stakeholders what they think about to be “churn” and the way they suppose they will cut back it. This dialogue will assist establish the kind of churn that’s of curiosity to the enterprise and the best way to measure it.

Relying on who you might be chatting with inside a company, they could consider churn in numerous phrases, they usually might even have alternative ways of quantifying churn.

Cancellation

The best and clearest definition of churn is when a enterprise requires the shopper to actively cancel a contract or a subscription. This creates a transparent cut-off date that marks the transition of a buyer to now not being a buyer. This definition of churn is normally straightforward to get everybody to agree on.

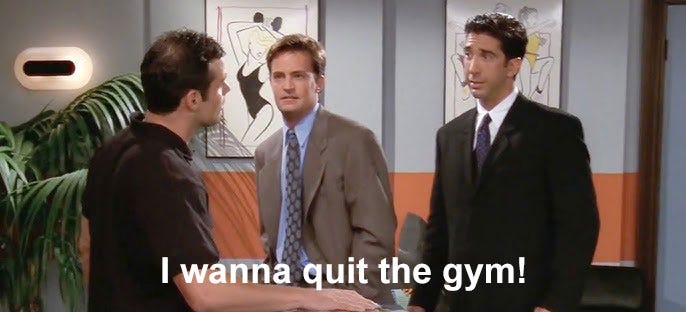

For one thing like a fitness center membership, one would usually signal a contract and pay a month-to-month membership charge. To give up the fitness center, one would subsequently must actively cancel the membership as specified within the contract. As Chandler Bing discovered in an episode of Associates, this should usually be finished in-person and his fitness center has very efficient methods to stop churn — even when they’re reactive moderately than preventive.

About 15 years in the past, I really needed to cancel a bank card to get out of paying for a membership at a Gold’s Gym in Alabama, USA, much like what Chandler and Ross attempt do after they fail on the fitness center. I had signed up for a membership whereas engaged on a 6-month challenge for an insurance coverage firm. After finishing the challenge, the fitness center required that the membership be cancelled in-person however I had returned to Denmark and didn’t have plans to return to Alabama.

Stopped Utilizing the Product

When a services or products doesn’t require a contract or subscription charge, however moderately have the shoppers pay for what they use, a buyer can merely cease utilizing the product with out ever canceling or in any other case notifying the supplier.

Examples of this are plentiful, however one which I’ve labored with and that is perhaps acquainted to many individuals can be a bank card.

Within the US, bank card corporations usually ship preapproved gives within the mail that embody incentives to join their playing cards, equivalent to incomes bonus factors for spending a specific amount inside a specified time. When you join the cardboard, you begin utilizing it to earn the bonus factors and should proceed utilizing it till a brand new supply comes alongside that you just discover extra engaging. Since most playing cards don’t have an annual charge, you’ll in all probability preserve the primary card however cease utilizing it.

In some of these situations, it’s far more troublesome and ambiguous to establish whether or not and when a buyer has churned. How lengthy ought to or not it’s because the card was final used? Ought to there be a decrease restrict to the scale of the cost earlier than it counts as use? What if it is just ever utilized in one place or for one merchandise? I’ve a bank card that I’ve had for a very long time and previously few years has solely been used to pay $1.99 per thirty days for extra Google Drive storage; does that depend as churn or as use?

Income Churn

Income churn — also referred to as partial churn — is characterised by a big discount in exercise or buying, and is in some methods much like clients who’ve stopped utilizing the merchandise as described above. It comes with the lots of the similar ambiguities and questions, however clients who’ve “income churned” would usually have been thought of clients if not for the truth that they used to spend extra previously.

Meal package companies can be instance of the sort of habits. I beforehand used a preferred meal package service, and we’d obtain 3 meals of 4 parts each week for a very long time, however when my daughter began school, we adjusted the plan to only 2 parts for every meal; successfully chopping our spend in half. We had been most undoubtedly nonetheless clients, however you may additionally make the case that we had partially churned by dramatically lowering our weekly subscription.

Product‑particular Churn

The enterprise will in all probability consider this as a particular case of partial churn, however to the product supervisor and for analytical functions that is extra prone to be handled as a particular case of full churn. The implications to the enterprise is perhaps totally different, and you’ll definitely hear this introduced up from totally different stakeholders.

For a enterprise that delivers a number of services and products to their clients, you might discover that particular person stakeholders inside that enterprise will probably be extra involved about clients who churn from their a part of the enterprise moderately than about clients, who churn from the enterprise as‑a‑complete. This may both be churn via a cancellation or from the shopper now not utilizing the product.

Consider a few of the hottest streaming companies for example of how this may look to totally different stakeholders. Disney is a serious participant on this market and as a buyer within the US, one can subscribe to a package deal that features Disney+, Hulu, and ESPN; that is the “Disney Bundle Trio”. If a buyer adjustments their plan from all three to at least one that simply consists of Disney+ and Hulu (the “Disney Bundle Duo”), then this might be seen as income churn. Nevertheless, for the product supervisor of the ESPN streaming platform, this might seem like buyer churn as they now have one buyer fewer than earlier than.

Earlier than embarking on any form of knowledge evaluation, it’s crucial to know which stakeholder(s) you might be speaking to and what sort of churn they’re searching for. Having these conversations with the enterprise is a requirement as you may simply forge down the fallacious path and discover that no matter you current on the finish doesn’t match the expectations of your viewers. In the event you lay out these totally different potential definitions of churn for the enterprise to select from, chances are high that they’ll need all of them, however you continue to want to begin someplace and with one among them.

At this stage, it’s definitely worth the time to not simply communicate with the executives or line of enterprise managers however to interview just a few choose gross sales representatives, account managers, or regardless of the titles is perhaps. These people deal instantly with the shoppers and they’re those who will ultimately be requested to place your perception into motion. They’ll usually have data about their clients that doesn’t essentially filter as much as administration or is typically is dismissed by administration. A few of what you study will probably be apocryphal and most of will probably be anecdotal, however it would if nothing else permit you to ask the best questions and to assessment the info to substantiate or deny a few of these tales and hypotheses.

A second — however equally vital — benefit from listening to the gross sales representatives is that this could go an extended approach to construct a degree of belief. If you may make the gross sales representatives really feel like they’ve been heard and that their considerations have been considered, then they’re extra prone to belief the outcomes and suggestions from you and from the fashions.

As soon as the kind of churn has been agreed upon it is perhaps time to bust out some knowledge. Step one can be to make sure that there’s knowledge out there to substantiate or deny whether or not a buyer has churned or not. The second step can be to get a benchmark of the present degree of churn to substantiate that it truly is price pursuing a method to cut back churn.

One group that I labored with as a marketing consultant just a few years in the past wished assist with a current enhance in churn, which appeared very affordable at first look. As part of the invention and enterprise perceive part of this challenge, we mentioned the definition of churn, they usually considered churn because the failure to resume a contract; every contract ran for a sure variety of months after which it could get renewed and run for an additional set variety of months and so forth. So past being product‑particular as described above, this definition was contract‑particular.

Additional investigation revealed that whereas contracts had been renewed at a decrease fee than earlier than, the overall variety of lively contracts had not decreased and this was attributed to a brand new incentive program for the gross sales crew, who had been paid an additional bonus (often called a SPIFF) for brand spanking new contracts. Nevertheless, they didn’t obtain related bonuses for contract renewals. If you understand something about gross sales, you’ll be able to in all probability guess the place that is going. Due to the motivation construction, gross sales would create new contracts for present clients moderately than renew the expiring contracts, thus making it seem like there was a rise in churn as a result of the enterprise measured contracts moderately than clients. Creating a brand new contract was considerably extra bother each on the gross sales crew and on the shopper, so it clearly was not finished with each contract — that may have been straightforward to identify — however principally for contracts that required some form of adjustment and must undergo a authorized assessment or the same course of both means.

Because it turned out, there actually was not a lot of a rise in churn, however a newly instituted and lopsided incentive construction had made the earlier metric of churn deceptive.