Three property have been chosen as representatives of diversified exposures:

- SPY (S&P 500 ETF)

- QQQ (Nasdaq 100 ETF)

- AAPL (Apple Inc.)

Day by day adjusted shut costs have been collected, and log-returns have been computed. The next strategies have been carried out:

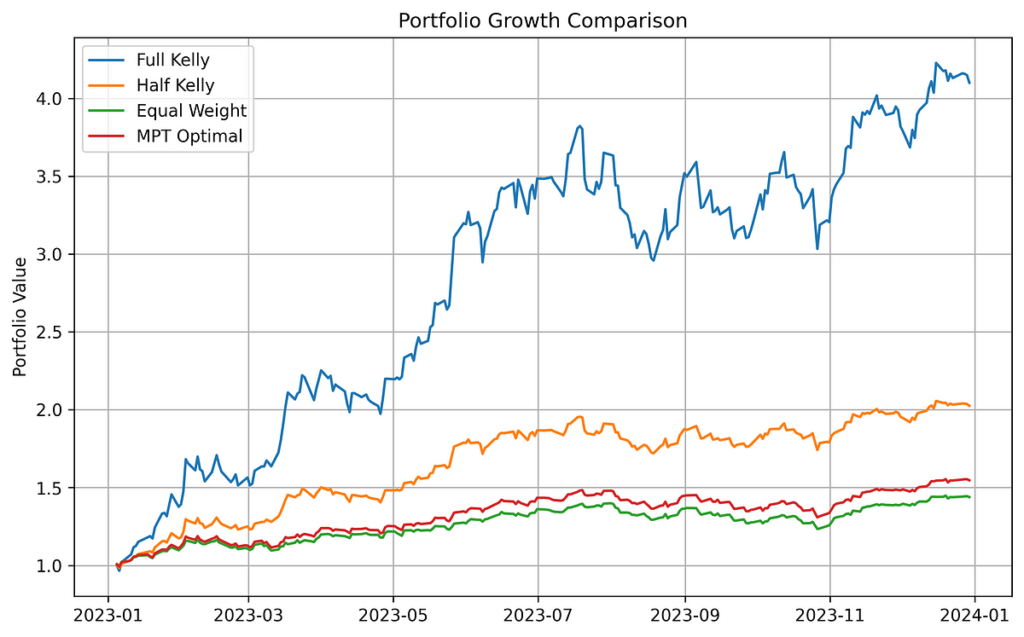

- Kelly Criterion:

Allocates weights based mostly on the inverse covariance matrix of log returns and their anticipated imply:

This method maximizes geometric development however doesn’t account for short-term volatility.

2. Fractional Kelly:

To mitigate the volatility and overfitting threat of full Kelly, we simulate a 50% scaled model — a typical follow in hedge fund threat administration.

3. Imply-Variance Optimization:

Traditional Markowitz framework, fixing for the portfolio that maximizes the Sharpe ratio below long-only constraints.

4. Equal Weight:

A naive however strong benchmark, allocating equally throughout all property.