You’ve most likely used the traditional distribution one or two instances too many. All of us have — It’s a real workhorse. However generally, we run into issues. As an illustration, when predicting or forecasting values, simulating information given a selected data-generating course of, or after we attempt to visualise mannequin output and clarify them intuitively to non-technical stakeholders. Immediately, issues don’t make a lot sense: can a person actually have made -8 clicks on the banner? And even 4.3 clicks? Each are examples of how depend information doesn’t behave.

I’ve discovered that higher encapsulating the information producing course of into my modelling has been key to having smart mannequin output. Utilizing the Poisson distribution when it was applicable has not solely helped me convey extra significant insights to stakeholders, however it has additionally enabled me to supply extra correct error estimates, higher Inference, and sound decision-making.

On this submit, my intention is that will help you get a deep intuitive really feel for the Poisson distribution by strolling by means of instance purposes, and taking a dive into the foundations — the maths. I hope you study not simply the way it works, but additionally why it really works, and when to use the distribution.

If you recognize of a useful resource that has helped you grasp the ideas on this weblog significantly nicely, you’re invited to share it within the feedback!

Define

- Examples and use circumstances: Let’s stroll by means of some use circumstances and sharpen the instinct I simply talked about. Alongside the way in which, the relevance of the Poisson Distribution will turn into clear.

- The foundations: Subsequent, let’s break down the equation into its particular person elements. By learning every half, we’ll uncover why the distribution works the way in which it does.

- The assumptions: Geared up with some formality, will probably be simpler to know the assumptions that energy the distribution, and on the similar time set the boundaries for when it really works, and when not.

- When actual life deviates from the mannequin: Lastly, let’s discover the particular hyperlinks that the Poisson distribution has with the Unfavourable Binomial distribution. Understanding these relationships can deepen our understanding, and supply alternate options when the Poisson distribution shouldn’t be suited to the job.

Instance in an internet market

I selected to deep dive into the Poisson distribution as a result of it ceaselessly seems in my day-to-day work. On-line marketplaces depend on binary person decisions from two sides: a vendor deciding to listing an merchandise and a purchaser deciding to make a purchase order. These micro-behaviours drive provide and demand, each within the quick and long run. A market is born.

Binary decisions mixture into counts — the sum of many such selections as they happen. Connect a timeframe to this counting course of, and also you’ll begin seeing Poisson distributions in all places. Let’s discover a concrete instance subsequent.

Think about a vendor on a platform. In a given month, the vendor could or could not listing an merchandise on the market (a binary selection). We’d solely know if she did as a result of then we’d have a measurable depend of the occasion. Nothing stops her from itemizing one other merchandise in the identical month. If she does, we depend these occasions. The full could possibly be zero for an inactive vendor or, say, 120 for a extremely engaged vendor.

Over a number of months, we might observe a various variety of listed gadgets by this vendor — generally fewer, generally extra — hovering round a mean month-to-month itemizing charge. That’s primarily a Poisson course of. Once we get to the assumptions part, you’ll see what we needed to assume away to make this instance work.

Different examples

Different phenomena that may be modelled with a Poisson distribution embrace:

- Sports activities analytics: The variety of targets scored in a match between two groups.

- Queuing: Prospects arriving at a assist desk or buyer help calls.

- Insurance coverage: The variety of claims made inside a given interval.

Every of those examples warrants additional inspection, however for the rest of this submit, we’ll use {the marketplace} instance as an example the interior workings of the distribution.

The mathy bit

… or foundations.

I discover opening up the likelihood mass operate (PMF) of distributions useful to understanding why issues work as they do. The PMF of the Poisson distribution goes like:

The place λ is the speed parameter, and 𝑘 is the manifested depend of the random variable (𝑘 = 0, 1, 2, 3, … occasions). Very neat and compact.

Contextualising λ and ok: {the marketplace} instance

Within the context of our earlier instance — a vendor itemizing gadgets on our platform — λ represents the vendor’s common month-to-month listings. Because the anticipated month-to-month worth for this vendor, λ orchestrates the variety of gadgets she would listing in a month. Notice that λ is a Greek letter, so learn: λ is a parameter that we will estimate from information. However, 𝑘 doesn’t maintain any details about the vendor’s idiosyncratic behaviour. It’s the goal worth we set for the variety of occasions which will occur to find out about its likelihood.

The twin position of λ because the imply and variance

Once I mentioned that λ orchestrates the variety of month-to-month listings for the vendor, I meant it fairly actually. Specifically, λ is each the anticipated worth and variance of the distribution, indifferently, for all values of λ. Which means that the mean-to-variance ratio (index of dispersion) is at all times 1.

To place this into perspective, the traditional distribution requires two parameters — 𝜇 and 𝜎², the typical and variance respectively — to completely describe it. The Poisson distribution achieves the identical with only one.

Having to estimate just one parameter may be useful for parametric inference. Particularly, by decreasing the variance of the mannequin and rising the statistical energy. However, it may be too limiting of an assumption. Alternate options just like the Unfavourable Binomial distribution can alleviate this limitation. We’ll discover that later.

Breaking down the likelihood mass operate

Now that we all know the smallest constructing blocks, let’s zoom out one step: what’s λᵏ, 𝑒^⁻λ, and 𝑘!, and extra importantly, what’s every of those elements’ operate in the entire?

- λᵏ is a weight that expresses how seemingly it’s for 𝑘 occasions to occur, provided that the expectation is λ. Notice that “seemingly” right here doesn’t imply a likelihood, but. It’s merely a sign power.

- 𝑘! is a combinatorial correction in order that we will say that the order of the occasions is irrelevant. The occasions are interchangeable.

- 𝑒^⁻λ normalises the integral of the PMF operate to sum as much as 1. It’s known as the partition operate of exponential-family distributions.

In additional element, λᵏ relates the noticed worth 𝑘 to the anticipated worth of the random variable, λ. Intuitively, extra likelihood mass lies across the anticipated worth. Therefore, if the noticed worth lies near the expectation, the likelihood of occurring is bigger than the likelihood of an commentary far faraway from the expectation. Earlier than we will cross-check our instinct with the numerical behaviour of λᵏ, we have to contemplate what 𝑘! does.

Interchangeable occasions

Had we cared in regards to the order of occasions, then every distinctive occasion could possibly be ordered in 𝑘! methods. However as a result of we don’t, and we deem every occasion interchangeable, we “divide out” 𝑘! from λᵏ to appropriate for the overcounting.

Since λᵏ is an exponential time period, the output will at all times be bigger as 𝑘 grows, holding λ fixed. That’s the reverse of our instinct that there’s most likelihood when λ = 𝑘, because the output is bigger when 𝑘 = λ + 1. However now that we all know in regards to the interchangeable occasions assumption — and the overcounting problem — we all know that we’ve got to consider 𝑘! like so: λᵏ 𝑒^⁻λ / 𝑘!, to see the behaviour we anticipate.

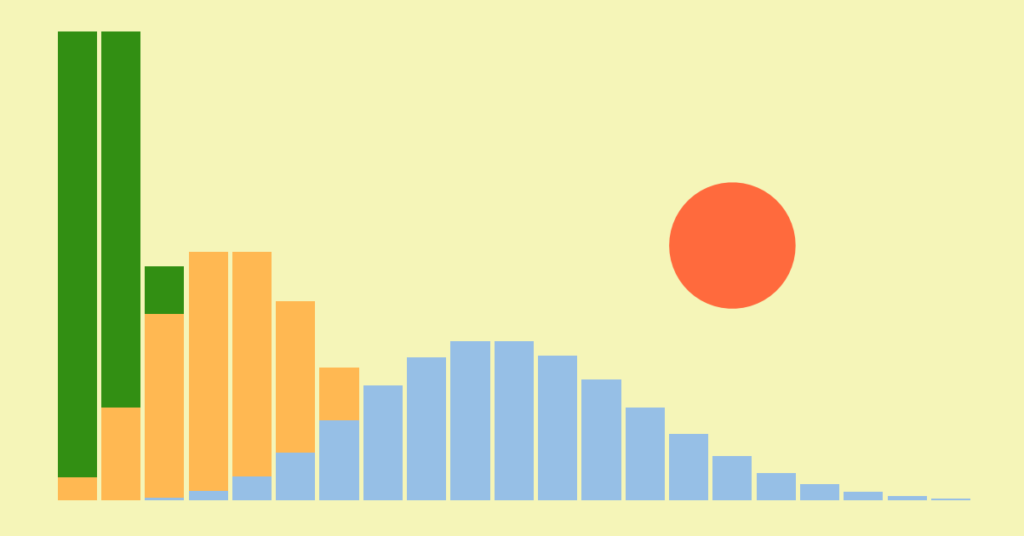

Now let’s verify the instinct of the connection between λ and 𝑘 by means of λᵏ, corrected for 𝑘!. For a similar λ, say λ = 4, we must always see λᵏ 𝑒^⁻λ / 𝑘! to be smaller for values of 𝑘 which are far faraway from 4, in comparison with values of 𝑘 that lie near 4. Like so: inline code: 4²/2 = 8 is smaller than 4⁴/24 = 10.7. That is in step with the instinct of a better chance of 𝑘 when it’s close to the expectation. The picture under reveals this relationship extra usually, the place you see that the output is bigger as 𝑘 approaches λ.

The assumptions

First, let’s get one factor off the desk: the distinction between a Poisson course of, and the Poisson distribution. The course of is a stochastic continuous-time mannequin of factors taking place in given interval: 1D, a line; 2D, an space, or greater dimensions. We, information scientists, most frequently cope with the one-dimensional case, the place the “line” is time, and the factors are the occasions of curiosity — I dare to say.

These are the assumptions of the Poisson course of:

- The prevalence of 1 occasion doesn’t have an effect on the likelihood of a second occasion. Consider our vendor occurring to listing one other merchandise tomorrow indifferently of getting achieved so already immediately, or the one from 5 days in the past for that matter. The purpose right here is that there isn’t a reminiscence between occasions.

- The common charge at which occasions happen, is unbiased of any prevalence. In different phrases, no occasion that occurred (or will occur) alters λ, which stays fixed all through the noticed timeframe. In our vendor instance, which means itemizing an merchandise immediately doesn’t enhance or lower the vendor’s motivation or chance of itemizing one other merchandise tomorrow.

- Two occasions can’t happen at precisely the identical prompt. If we had been to zoom at an infinite granular stage on the timescale, no two listings may have been positioned concurrently; at all times sequentially.

From these assumptions — no reminiscence, fixed charge, occasions taking place alone — it follows that 1) any interval’s variety of occasions is Poisson-distributed with parameter λₜ and a couple of) that disjoint intervals are unbiased — two key properties of a Poisson course of.

A Notice on the distribution:

The distribution merely describes chances for varied numbers of counts in an interval. Strictly talking, one can use the distribution pragmatically at any time when the information is nonnegative, may be unbounded on the best, has imply λ, and fairly fashions the information. It could be simply handy if the underlying course of is a Poisson one, and really justifies utilizing the distribution.

{The marketplace} instance: Implications

So, can we justify utilizing the Poisson distribution for our market instance? Let’s open up the assumptions of a Poisson course of and take the take a look at.

Fixed λ

- Why it could fail: The vendor has patterned on-line exercise; holidays; promotions; listings are seasonal items.

- Consequence: λ shouldn’t be fixed, resulting in overdispersion (mean-to-variance ratio is bigger than 1, or to temporal patterns.

Independence and memorylessness

- Why it could fail: The propensity to listing once more is greater after a profitable itemizing, or conversely, itemizing as soon as depletes the inventory and intervenes with the propensity of itemizing once more.

- Consequence: Two occasions are now not unbiased, because the prevalence of 1 informs the prevalence of the opposite.

Simultaneous occasions

- Why it could fail: Batch-listing, a brand new function, was launched to assist the sellers.

- Consequence: A number of listings would come on-line on the similar time, clumped collectively, and they’d be counted concurrently.

Balancing rigour and pragmatism

As Knowledge Scientists on the job, we could really feel trapped between rigour and pragmatism. The three steps under ought to offer you a sound basis to resolve on which facet to err, when the Poisson distribution falls quick:

- Pinpoint your objective: is it inference, simulation or prediction, and is it about high-stakes output? Record the worst factor that may occur, and the price of it for the enterprise.

- Determine the issue and resolution: why does the Poisson distribution not match, and what are you able to do about it? listing 2-3 options, together with altering nothing.

- Stability positive aspects and prices: Will your workaround enhance issues, or make it worse? and at what price: interpretability, new assumptions launched and assets used. Does it assist you in reaching your objective?

That mentioned, listed here are some counters I take advantage of when wanted.

When actual life deviates out of your mannequin

Every thing described up to now pertains to the usual, or homogenous, Poisson course of. However what if actuality begs for one thing totally different?

Within the subsequent part, we’ll cowl two extensions of the Poisson distribution when the fixed λ assumption doesn’t maintain. These aren’t mutually unique, however neither they’re the identical:

- Time-varying λ: a single vendor whose itemizing charge ramps up earlier than holidays and slows down afterward

- Blended Poisson distribution: a number of sellers itemizing gadgets, every with their very own λ may be seen as a mix of assorted Poisson processes

Time-varying λ

The primary extension permits λ to have its personal worth for every time t. The PMF then turns into

The place the variety of occasions 𝐾(𝑇) in an interval 𝑇 follows the Poisson distribution with a charge now not equal to a set λ, however one equal to:

Extra intuitively, integrating over the interval 𝑡 to 𝑡 + 𝑖 provides us a single quantity: the anticipated worth of occasions over that interval. The integral will differ by every arbitrary interval, and that’s what makes λ change over time. To grasp how that integration works, it was useful for me to consider it like this: if the interval 𝑡 to 𝑡₁ integrates to three, and 𝑡₁ to 𝑡₂ integrates to five, then the interval 𝑡 to 𝑡₂ integrates to eight = 3 + 5. That’s the 2 expectations summed up, and now the expectation of the whole interval.

Sensible implication

One could need to modeling the anticipated worth of the Poisson distribution as a operate of time. As an illustration, to mannequin an total change in pattern, or seasonality. In generative mannequin notation:

Time could also be a steady variable, or an arbitrary operate of it.

Course of-varying λ: Blended Poisson distribution

However then there’s a gotcha. Keep in mind once I mentioned that λ has a twin position because the imply and variance? That also applies right here. Trying on the “relaxed” PMF*, the one factor that adjustments is that λ can differ freely with time. Nevertheless it’s nonetheless the one and solely λ that orchestrates each the anticipated worth and the dispersion of the PMF*. Extra exactly, 𝔼[𝑋] = Var(𝑋) nonetheless holds.

There are numerous causes for this constraint to not maintain in actuality. Mannequin misspecification, occasion interdependence and unaccounted for heterogeneity could possibly be the problems at hand. I’d wish to deal with the latter case, because it justifies the Unfavourable Binomial distribution — one of many subjects I promised to open up.

Heterogeneity and overdispersion

Think about we aren’t coping with one vendor, however with 10 of them itemizing at totally different depth ranges, λᵢ, the place 𝑖 = 1, 2, 3, …, 10 sellers. Then, primarily, we’ve got 10 Poisson processes occurring. If we unify the processes and estimate the grand λ, we simplify the combination away. That means, we get an accurate estimate of all sellers on common, however the ensuing grand λ is naive and doesn’t know in regards to the unique unfold of λᵢ. It nonetheless assumes that the variance and imply are equal, as per the axioms of the distribution. This can result in overdispersion and, in flip, to underestimated errors. In the end, it inflates the false optimistic charge and drives poor decision-making. We want a technique to embrace the heterogeneity amongst sellers’ λᵢ.

Unfavourable binomial: Extending the Poisson distribution

Among the many few methods one can have a look at the Unfavourable Binomial distribution, a method is to see it as a compound Poisson course of — 10 sellers, sounds acquainted but? Which means a number of unbiased Poisson processes are summed as much as a single one. Mathematically, first we draw λ from a Gamma distribution: λ ~ Γ(r, θ), then we draw the depend 𝑋 | λ ~ Poisson(λ).

In a single picture, it’s as if we might pattern from a lot Poisson distributions, corresponding to every vendor.

The extra exposing alias of the Unfavourable binomial distribution is Gamma-Poisson combination distribution, and now we all know why: the dictating λ comes from a steady combination. That’s what we wanted to elucidate the heterogeneity amongst sellers.

Let’s simulate this situation to achieve extra instinct.

First, we draw λᵢ from a Gamma distribution: λᵢ ~ Γ(r, θ). Intuitively, the Gamma distribution tells us in regards to the selection within the depth — itemizing charge — amongst the sellers.

On a sensible observe, one can instill their assumptions in regards to the diploma of heterogeneity on this step of the mannequin: how totally different are sellers? By various the degrees of heterogeneity, one can observe the influence on the ultimate Poisson-like distribution. Doing the sort of checks (i.e., posterior predictive verify), is frequent in Bayesian modeling, the place the assumptions are set explicitly.

Within the second step, we plug the obtained λ into the Poisson distribution: 𝑋 | λ ~ Poisson(λ), and acquire a Poisson-like distribution that represents the summed subprocesses. Notably, this unified course of has a bigger dispersion than anticipated from a homogeneous Poisson distribution, however it’s in step with the Gamma combination of λ.

Heterogeneous λ and inference

A sensible consequence of introducing flexibility into your assumed distribution is that inference turns into more difficult. Extra parameters (i.e., the Gamma parameters) must be estimated. Parameters act as versatile explainers of the information, tending to overfit and clarify away variance in your variable. The extra parameters you’ve gotten, the higher the reason could seem, however the mannequin additionally turns into extra prone to noise within the information. Larger variance reduces the ability to establish a distinction in means, if one exists, as a result of — nicely — it will get misplaced within the variance.

Countering the lack of energy

- Affirm whether or not you certainly want to increase the usual Poisson distribution. If not, simplify to the best, most match mannequin. A fast verify on overdispersion could suffice for this.

- Pin down the estimates of the Gamma combination distribution parameters utilizing regularising, informative priors (suppose: Bayes).

Throughout my analysis course of for penning this weblog, I realized an important deal in regards to the connective tissue underlying all of this: how the binomial distribution performs a basic position within the processes we’ve mentioned. And whereas I’d like to ramble on about this, I’ll reserve it for an additional submit, maybe. Within the meantime, be happy to share your understanding within the feedback part under 👍.

Conclusion

The Poisson distribution is an easy distribution that may be extremely appropriate for modelling depend information. Nevertheless, when the assumptions don’t maintain, one can prolong the distribution by permitting the speed parameter to differ as a operate of time or different elements, or by assuming subprocesses that collectively make up the depend information. This added flexibility can tackle the constraints, however it comes at a value: elevated flexibility in your modelling raises the variance and, consequently, undermines the statistical energy of your mannequin.

In case your finish objective is inference, you could need to suppose twice and contemplate exploring easier fashions for the information. Alternatively, swap to the Bayesian paradigm and leverage its built-in resolution to regularise estimates: informative priors.

I hope this has given you what you got here for — a greater instinct in regards to the Poisson distribution. I’d love to listen to your ideas about this within the feedback!

Until in any other case famous, all photographs are by the writer.

Initially revealed at https://aalvarezperez.github.io on January 5, 2025.