Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

A number of days after I launched ResiClub in October 2023, I wrote an article titled “The key housing market metric heading into 2024.” In it, I reaffirmed a degree I had additionally made at Fortune in 2022: that some conventional guidelines of thumb—i.e., months-of-supply thresholds for what constitutes a patrons’ market versus a sellers’ market—may battle on this submit–Pandemic Housing Growth setting, the place there’s downward stress on costs.

In the intervening time, I recommended that an easy-to-create and helpful metric for housing stakeholders to comply with—one which helps gauge short-term pricing momentum and whether or not draw back danger would possibly manifest—is an area market’s degree of energetic stock in comparison with that very same market’s stock degree in the identical month of pre-pandemic 2019.

The pondering was that markets the place energetic stock stays nicely beneath 2019 ranges would nonetheless exhibit some tightness, whereas these the place stock has surged again to or above pre-pandemic 2019 ranges would expertise a shift within the supply-demand equilibrium extra in favor of homebuyers.

Heading into 2025, I recreated that analysis showing the dynamic was still holding true.

Quick-forward to as we speak, and this explicit information reduce nonetheless proves helpful (time beyond regulation ResiClub believes its usefulness will diminish—simply not proper now).

Usually talking, housing markets the place energetic housing stock on the market has surged above pre-pandemic 2019 ranges have skilled weaker or softer house worth progress (and even outright house worth declines) over the previous 36 months. Conversely, housing markets the place energetic housing stock on the market stays far beneath pre-pandemic 2019 ranges have, typically talking, skilled extra resilient house worth progress over the previous 36 months.

Certainly, simply take a look at the scatter plot beneath displaying “Shift in house costs since their native 2022 peak” Vs. “energetic stock on the market now in comparison with the identical month in 2019” for the nation’s 250 largest metro space housing markets.

!perform(){“use strict”;window.addEventListener(“message”,(perform(a){if(void 0!==a.information[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.information[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.information[“datawrapper-height”][t]+”px”;r.model.top=d}}}))}();

Beneath is identical scatter plot because the one above, solely its coloration scheme is adjusted to indicate which markets have LESS energetic stock now than in 2019 (BROWN) and which markets have MORE energetic stock proper now than in 2019 (GREEN).

Click here for an interactive model of the scatter plot beneath.

!perform(){“use strict”;window.addEventListener(“message”,(perform(a){if(void 0!==a.information[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.information[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.information[“datawrapper-height”][t]+”px”;r.model.top=d}}}))}();

To see if this information reduce nonetheless proves helpful, let’s swap out “house worth since their native 2022 peak” for “year-over-year house worth shift.”

The reply is sure—the pattern nonetheless holds. (Just lately, each the Wall Street Journal and John Burns Research and Consulting created their very own variations of this longtime ResiClub scatter plot.)

!perform(){“use strict”;window.addEventListener(“message”,(perform(a){if(void 0!==a.information[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.information[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.information[“datawrapper-height”][t]+”px”;r.model.top=d}}}))}();

Beneath is identical scatter plot because the one above, solely its coloration scheme is adjusted to indicate which markets have LESS energetic stock now than in 2019 (BROWN) and which markets have MORE energetic stock proper now than in 2019 (GREEN).

!perform(){“use strict”;window.addEventListener(“message”,(perform(a){if(void 0!==a.information[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.information[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.information[“datawrapper-height”][t]+”px”;r.model.top=d}}}))}();

The present regional bifurcation—higher weak point in Solar Belt and Mountain West boomtowns and higher resiliency within the Northeast and Midwest—shouldn’t be stunning to ResiClub readers. Provided that we cowl that regional bifurcation steadily, we’re not going to spend time on this piece discussing what’s driving that bifurcation.

As a substitute, let’s focus on why this explicit information reduce is beneficial proper now, and why time beyond regulation it may turn out to be much less helpful.

This information reduce’s usefulness—proper now—defined

In the course of the Pandemic Housing Growth, housing demand surged quickly amid ultralow rates of interest, stimulus, and the distant work increase—which elevated demand for house and unlocked “WFH arbitrage” as excessive earners have been capable of maintain their revenue from a job in, say, NYC or L.A., and purchase in, say, Austin or Tampa. Federal Reserve researchers estimate “new development would have needed to enhance by roughly 300% to soak up the pandemic-era surge in demand.”

Not like housing demand, housing inventory provide isn’t as elastic and may’t ramp up as shortly. Consequently, the heightened pandemic period demand drained the market of energetic stock and overheated house costs, with U.S. house costs rising a staggering +43.2% between March 2020 and June 2022.

On the top of the Pandemic Housing Growth in spring 2022, a lot of the nation had 60% to 75% much less energetic stock than in 2019. As soon as mortgage charges spiked, nationwide housing demand cooled off.

Whereas many commentators view energetic stock and months of provide merely as measures of “provide,” ResiClub sees them extra as proxies for the supply-demand equilibrium. Massive swings in energetic stock or months of provide are normally pushed by shifts in housing demand. For instance, in the course of the Pandemic Housing Growth, surging demand prompted properties to promote sooner—pushing energetic stock down, at the same time as new listings remained regular.

Conversely, in recent times, weakening demand has led to slower gross sales, inflicting energetic stock to rise in lots of markets—at the same time as new listings fell beneath pattern.

For a market like Austin or Punta Gorda to surge from traditionally low energetic stock ranges in spring 2022 to now nicely above pre-pandemic 2019 ranges, it has taken a big shift within the stability of energy—from sellers to patrons.

That shift has additionally coincided with these markets experiencing outright house worth corrections. Conversely, regardless of the affordability shock, markets like Syracuse and Milwaukee nonetheless have energetic stock ranges nicely beneath 2019 ranges and proceed to see barely optimistic year-over-year house worth progress.

Stock wasn’t traditionally “excessive” again in 2019—so why does climbing again to 2019 ranges matter?

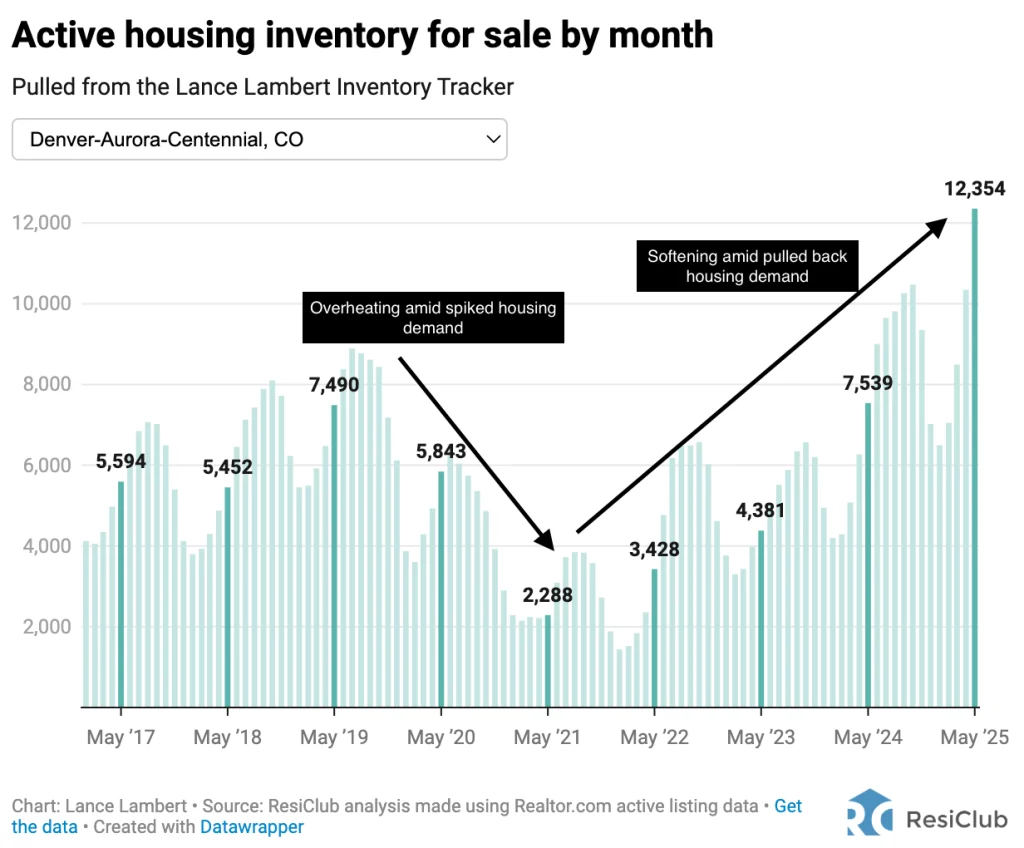

In the course of the Pandemic Housing Growth, housing demand overwhelmed the Denver metro housing market—pushing energetic housing stock on the market down to simply 2,288 properties by Might 2021, down 69% from the 7,490 listings in Might 2019.

Because the Pandemic Housing Growth fizzled out, and mortgage charges spiked, energetic stock on the market in Denver has spiked as much as 12,354 energetic listings as of Might 2025—65% above pre-pandemic Might 2019 ranges.

Whereas energetic stock on the market in Denver as we speak isn’t essentially that prime by historic comparability, the sharp bounce from 2022 stock ranges to 2025 ranges in such a brief window displays a fairly large shift within the supply-demand equilibrium. On the bottom that shift ought to really feel jarring.

That higher energetic stock bounce up in Denver has coincided with a higher home worth softening/weakening. Certainly, Denver metro space house costs as measured by ResiClub analysis of the Zillow House Worth Index are down 1.7% year-over-year, and down 7.3% since their 2022 peak.

Why, over time, this information reduce may show much less helpful

One of many widespread pushbacks I hear when evaluating as we speak’s energetic stock on the market to 2019 ranges is that some markets—like Austin and Punta Gorda—have bigger populations now than they did again in 2019.

It’s true that a number of the markets with increased stock as we speak in comparison with 2019 are additionally those which have skilled notable inhabitants progress in recent times. Nonetheless, that precise inhabitants progress—i.e., a bigger inhabitants base—isn’t the only real motive stock has jumped so shortly in locations like Austin and Punta Gorda. Slightly, it’s as a result of these markets have skilled a sharper weakening of their for-sale market because the Pandemic Housing Growth fizzled out. And that has helped push up unsold stock in these markets.

That stated, over time, adjustments in market dimension—particularly inhabitants and complete households—will naturally have an effect on what constitutes a “regular” degree of energetic stock. By 2035, for instance, evaluating energetic stock to 2019 ranges might be far much less significant than it has been in 2021-2025.

Some conventional guidelines of thumb have fallen brief this cycle

A rule of thumb in actual property is that something beneath a six-month provide of stock is taken into account a “vendor’s market,” whereas something above a six-month provide is a “purchaser’s market.” Nonetheless, that hasn’t all the time held true this cycle, and ResiClub’s view is that this rule of thumb is a bit outdated.

In lots of housing markets, together with Austin’s metro space, the place home costs started to say no in June 2022 with solely 2.1 months of stock, that rule hasn’t utilized successfully. The truth is, though Austin’s stock solely peaked at 5.2 months as of April 2025, according to Texas A&M University’s Texas Real Estate Research Center, house costs within the Austin metro have already fallen 22.8% from their 2022 peak, based on our analysis of the Zillow Home Value Index.

A greater measure of this incoming pricing weak point was the abrupt energetic stock bounce that occurred in Austin in spring/summer season 2022 (going from 0.4 months of stock in February 2022 to 2.1 in June 2022), which shortly pushed energetic listings close to/above pre-pandemic 2019 ranges.

Large image: In as we speak’s post-Pandemic Housing Growth panorama, evaluating a market’s present degree of energetic stock to its same-month 2019 baseline stays a helpful gauge for the shift within the supply-demand stability.

Whereas imperfect, this straightforward metric captures the diploma of tightness or softening higher than some conventional measures. Markets the place stock has surged nicely above 2019 ranges—like Austin or Punta Gorda—are usually those which have seen demand weaken most, restoring purchaser leverage and, in some circumstances, producing house worth corrections. In the meantime, markets the place stock stays far beneath 2019 ranges proceed to exhibit higher pricing resiliency.

This text is an unique take a look at a ResClub PRO research article that was initially printed on June tenth.