You click on on Tickeron considering, “AI buying and selling bot—sounds futuristic,” and then you definately’re knee‑deep in a dashboard filled with options: sample recognition, AI robots, sign brokers, digital brokers, development predictors. First ideas? Spectacular. However let’s dig deeper.

What Tickeron Is (and Isn’t)

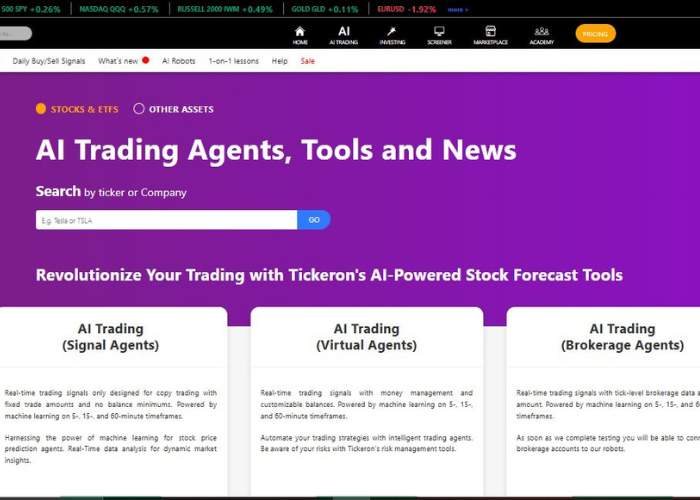

Tickeron payments itself as a one-stop AI buying and selling platform—assume sample scanners, AI robots, forecast engines, all below one roof. Good for quantitative-minded retail merchants eager to automate evaluation and generate real-time alerts. Not precisely constructed for informal inventory selecting or buy-and-hold traders.

Flashy buzzwords apart, it delivers precise instruments:

- Sample Recognition Engine scans for technical formations in shares, ETFs, crypto, Foreign exchange and ranks them with confidence scores.

- AI Robots are available in three flavors:

- Sign Brokers: fixed-trade, copy-style bots.

- Digital Brokers: simulated accounts, adjustable balances, cash administration.

- Brokerage Brokers: very superior, tick-level commerce copying (nonetheless in rollout).

Onboard is also an AI Pattern Prediction Engine, Screener, Time Machine (for backtesting), and a full Market of group portfolios and fashions.

Function Tour: Greater than Simply Hype

- Sample Alerts + Confidence Scores

The AI flags patterns (breakouts, chart setups) and provides each a chance and its inner confidence—helpful, although actual customers say accuracy varies. Some Reddit reviewers tried 20+ alerts; none hit their targets, even with purported 90% confidence. Truthful warning.

- AI Robots in Motion

These aren’t static indicators. You possibly can bookmark, observe, toggle notifications, allow autopilot which feeds trades into your Paper Commerce account. Digital Brokers handle threat, alter commerce sizes—they really feel extra sturdy.

- Actual-Time Metrics Desk

| Agent Sort | Time Frames | Threat Management | Actual/Simulated |

| Sign Brokers | 5, 15, 60 min | No | Copy-trade |

| Digital Brokers | 5, 15, 60 min | Sure (cash mgmt) | Simulated |

| Brokerage Brokers | 5, 15, 60 min | Tick-level threat | Stay (future) |

Agent stats embody Annualized Return, Sharpe Ratio, Revenue Issue, Revenue vs Drawdown. They supply each closed and open commerce logs.

My Fingers-On: Scratching the Floor

I spent per week enjoying round. I arrange observe on a pair Digital Brokers buying and selling tech shares, obtained alerts, watched their simulated trades. I additionally ran sample scans (Time Machine) on breakout candidates I used to be interested in. The interface felt intuitive—however nonetheless overwhelming at first.

Just a few moments stood out:

- Acquired a bullish breakout sign on an ETF, clicked particulars, noticed confidence 85%, worth 5% transfer—however value dropped the following day. That sucked.

- Watched a digital agent produce first rate returns on paper trades. Some days it churned skinny wins; different days it stacked larger returns—all tracked cleanly in dashboard.

- A high-school‑stage dealer good friend requested: “What if I tweak commerce measurement mid‑week?” Digital Brokers allow you to do exactly that, which is cool.

Assist? The platform has an Academy, tutorials, chatbot. Individuals say they assist, however evaluations present blended experiences—particularly cancellation or billing points. Just a few Trustpilot customers report unwelcome billing, issue canceling, no refunds.

Professionals & Cons Desk

| Professionals | Cons / Caveats |

| All-in-one platform: patterns, robots, forecasting instruments | Accuracy uneven on sample alerts—some customers see failures |

| A number of brokers with alternative of threat vs simplicity | Steep studying curve for those who’re new to quant buying and selling |

| Versatile brokers: timeframes (5, 15, 60 min), cash controls | Actual-money execution nonetheless restricted to Brokerage Brokers |

| Clear stats: Sharpe, drawdown, revenue issue, closed trades | Assist/billing that includes complaints about refunds and cancelation |

| Simulated autopilot and paper trades to check methods | Trustpilot rating 3.2/5—some customers sad or declare deceptive trial |

Emotional Diary: What It Felt Like

At first I believed: “Wow, have a look at all these bots!” Somewhat excited. However after my first false‑sign—confidence 90% but value tumbled—I used to be deflated. Felt just like the AI had confidence, however markets laughed. Then I reminded myself: sample scanning isn’t a crystal ball—it’s statistical.

After a couple of days, I warmed to Digital Brokers. Watching a simulated portfolio tick up in actual time, with clear efficiency metrics, felt empowering. It’s like having a nerdy buddy crunch charts when you sip espresso.

That stated, after I learn actual customers obtained charged after cancellation, and the Trustpilot horror tales—felt uneasy. Belief issues while you’re giving a platform cash each month.

Pricing & Worth

Tickeron plans begin round $60/month, and rise relying on entry (Sign, Digital, Skilled). Some sources be aware premium worth, however credit-earning towards different instruments complicates issues.

WallStreetZen suggests for pure inventory picks, their Zen Investor annual plan (~$99/yr) could be cheaper. However you lose entry to the bot toolbox.

When you’re contemplating simply alerts or sample scanning, Tickeron might be heavy overhead. However if you’d like full AI automation instruments, it’s priced competitively.

Ultimate Take: Is It the Greatest AI Buying and selling Bot Platform?

Tickeron is neither good nor the simplest. It’s highly effective however messy. For the quant‑curious retail dealer, it offers a playground of AI-powered instruments. However outcomes differ—some customers rave, others warn.

When you’re recreation to be taught, prepared to paper-trade first, and never freak out when confidence‑rated alerts fail—you would possibly discover worth. For me, I’d deal with it as threat‑managed experimentation zone, not autopilot to riches.

Ought to You Attempt It?

- Need AI robots, sample scanners, reside metrics—all built-in? Price a glance.

- Favor simulated testing earlier than risking actual money? Digital Brokers and paper trades assist.

- Hate handbook automation? Autopilot would possibly change your workflow.

However for those who anticipate robots to provide you a flawless edge—be skeptical. No bot forecasts completely. Additionally, learn their cancellation coverage earlier than subscribing—some customers obtained burned.

My Parting Recommendation

Attempt the free trial/paper commerce instruments first. Decide a pair Digital Brokers, observe their efficiency, allow them to simulate trades for per week. Use the Sample Search Engine sparingly—validate alerts earlier than trusting them. And regulate billing, cancellation deadlines.

Tickeron isn’t magic, however it may be a succesful assistant for those who use it proper. It’s like driving a high-performance bike: exhilarating while you deal with it effectively, harmful for those who ignore the highway. Let me know for those who’d like assist selecting brokers or calibrating filters—glad to speak technique.