Bitcoin’s worth has blasted by means of the much-anticipated threshold of $100,000, elevating questions on how a lot increased it may go – and whether or not it could actually shake off its infamous volatility.

The world’s largest cryptocurrency rose to round $103,400 shortly after 04:00 GMT on Thursday, earlier than falling barely.

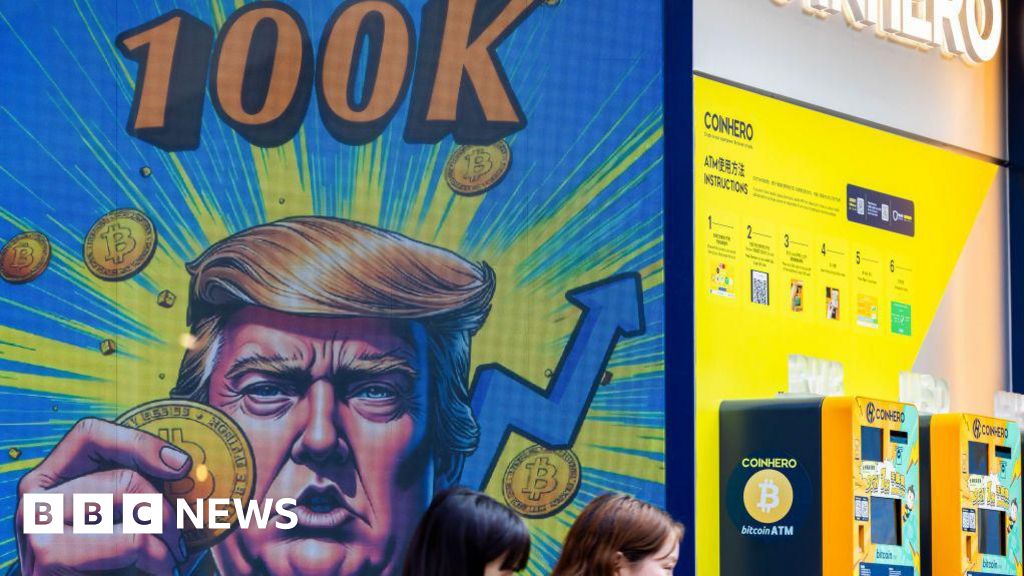

Dan Coatsworth, funding analyst at AJ Bell, described it as a “magic second” for the cryptocurrency and mentioned it had a “clear hyperlink” to Donald Trump’s election victory.

Trump took to social media to have fun the milestone, posting “congratulations Bitcoiners” and “you are welcome!”

The president-elect had beforehand pledged to make the US the “crypto capital” and “Bitcoin superpower” of the world, serving to to push Bitcoin’s worth increased as soon as he was elected president.

It broke by means of the $100k barrier after Trump mentioned he would nominate former Securities and Change Fee (SEC) commissioner Paul Atkins to run the Wall Road regulator.

Mr Atkins is seen as being way more pro-cryptocurrency than the present head, Gary Gensler.

“Clearly there may be anticipation that the brand new administration goes to be considerably extra beneficial to crypto than the previous administration was,” mentioned Andrew O’Neill, digital belongings skilled at S&P World.

“So for the value of Bitcoin, I feel that that is what’s pushed the pattern to this point [and it will] possible proceed into the brand new 12 months,” he added.

Nevertheless, Bitcoin has a historical past of sharp falls in addition to speedy rises – and a few analysts have cautioned that’s unlikely to alter.

“Lots of people have gotten wealthy from the cryptocurrency hovering in worth this 12 months, however this high-risk asset isn’t appropriate for everybody,” mentioned Mr Coatsworth.

“It’s risky, unpredictable and is pushed by hypothesis, none of which makes for a sleep-at-night funding.”

Throughout the US presidential election marketing campaign, Trump sought to attraction to cryptocurrency buyers with a promise to sack Gary Gensler – chair of the US monetary regulator the Securities and Change Fee (SEC) – on “day one” of his presidency.

Mr Gensler’s method to the cryptocurrency sector has been decidedly much less pleasant than Trump’s.

He told the BBC in September it was an trade “rife with fraud and hucksters and grifters”.

Underneath his management, the SEC introduced a report 46 crypto-related enforcement actions in opposition to corporations in 2023.

Mr Gensler mentioned in November he would step down on 20 January – the day of Trump’s inauguration.

The selection of Paul Atkins to switch him on the helm of the SEC has been welcomed by crypto advocates.

Mike Novogratz, founder and chief govt of US crypto agency Galaxy Digital mentioned he hoped the “clearer regulatory path” would now speed up the digital forex ecosystem’s entry into “the monetary mainstream.”

Bitcoin has seen fewer drastic falls in worth throughout 2024 than in earlier years.

In 2022 its worth fell sharply beneath $16,000 after crypto alternate FTX collapsed into bankruptcy.

Plenty of key occasions moreover Trump’s victory within the election have helped enhance investor confidence that its worth will hold going up.

The SEC approved several spot Bitcoin exchange traded funds (ETFs) permitting large funding corporations like Blackrock, Constancy and Grayscale to promote merchandise based mostly on the value of Bitcoin.

A few of these merchandise have seen billions of {dollars} in money inflows.

However its potential to instantly plummet in worth serves as a reminder that it isn’t like orthodox currencies – and buyers don’t have any safety or recourse in the event that they lose cash on Bitcoin investments.

Carol Alexander, professor of finance at Sussex College, informed BBC Information that worry of lacking out (FOMO) amongst youthful individuals will see Bitcoin’s worth proceed to rise.

However she added that whereas this might spark an increase in different cryptocurrencies, most of the youthful buyers investing in meme cash are dropping cash.

Kathleen Breitman, co-founder of one other cryptocurrency – Tezos – additionally had a phrase of warning for these tempted to spend money on Bitcoin.

“These are markets that have a tendency to maneuver on momentum so it is advisable to be terribly cautious with it,” she informed the BBC.