Intel, a fallen Silicon Valley icon making an attempt to revive its repute as America’s most outstanding semiconductor firm, is working with the Trump administration on a plan to show over the operation of its chip-making vegetation to a large Taiwanese rival.

Over the previous few months, Frank Yeary, the interim government chairman of Intel, has spoken with administration officers and leaders of Taiwan Semiconductor Manufacturing Firm a few deal that might separate Intel’s ailing manufacturing enterprise from its semiconductor design and product enterprise, in line with 4 individuals with data of the plan, who spoke on the situation of anonymity.

TSMC, which produces an estimated 90 % of the world’s most superior semiconductors, would assume management of Intel’s manufacturing enterprise and take a majority stake within the enterprise alongside a consortium of traders that might embody non-public fairness corporations and different tech firms, the 4 individuals stated.

The Trump administration has inspired TSMC to do the deal. Howard Lutnick, President Trump’s nominee for commerce secretary, has been concerned within the conversations and considers them some of the consequential challenges of his new job, two of the individuals accustomed to the discussions stated.

It’s not clear how a lot of Intel’s manufacturing enterprise TSMC would take over or how a lot cash the Taiwanese firm would make investments. The deal might be restricted to Intel’s home vegetation, in states together with Oregon, Arizona and New Mexico, or additionally embody amenities in nations like Eire and Israel, the individuals stated.

Intel’s business prospects soured after it didn’t develop smartphone and synthetic intelligence chips. Regardless of the federal government’s finest efforts to revive the corporate by promising it billions of dollars of subsidies by the Biden administration’s CHIPS Act, Intel has continued to battle.

Intel and TSMC declined to remark. Mr. Lutnick didn’t reply to a request for remark.

Late final yr, Intel’s board approached TSMC to gauge its curiosity in some kind of partnership, two of the individuals accustomed to the talks stated. In January, TSMC’s chief government, C.C. Wei, met individually with Mr. Lutnick and Mr. Yeary to debate how a tie-up may work.

Mr. Yeary has been talking to Mr. Lutnick repeatedly concerning the thought since then, three of those individuals stated. The Intel chairman’s curiosity in cleaving the corporate has additionally opened the door for suitors considering buying Intel’s product enterprise, together with Qualcomm. A Qualcomm spokeswoman declined to remark.

Some particulars of the discussions had been beforehand reported by Digitimes, a Taiwanese information outlet, and Bloomberg.

The query now’s whether or not the Trump administration thinks an ailing nationwide champion like Intel is healthier off within the palms of a international firm or if the administration must seek for one other answer.

“Even with potential U.S. authorities help from the CHIPS Act and officers desirous to see the agency rebound and lead the renaissance of superior manufacturing within the U.S., the street forward might be powerful,” stated Paul Triolo, a accomplice at Albright Stonebridge Group who tracks the trade.

Hanging over the negotiations are questions on Mr. Trump’s strategy to the chips trade and Taiwan, which is sharply completely different from former President Joseph R. Biden Jr.’s technique. Mr. Trump has criticized the Biden administration’s investments in home chip manufacturing, threatened to impose tariffs on foreign-made chips, accused Taiwan of stealing the semiconductor trade away from america and questioned U.S. navy help for the island, which is looking for to defend itself in opposition to Beijing’s encroachment.

In remarks to Republican lawmakers in late January, Mr. Trump stated a big tariff, not subsidies, was all that was wanted to power chip firms again to america.

“We would like them to return again, and we don’t wish to give them billions of {dollars} like this ridiculous program that Biden has,” the president stated.

In his Jan. 29 Senate affirmation listening to, Mr. Lutnick appeared to walk a careful line on the CHIPS program. He described it as “obligatory and vital” and a “down fee” on bringing manufacturing again to america. However Mr. Lutnick refused to commit outright to honoring contracts that firms had already signed with the federal government.

To placate Mr. Trump, Taiwanese officers and businesspeople have been cultivating ties with individuals in his orbit, floating new offers within the fuel sector and making an attempt to elucidate how Taiwanese semiconductor manufacturing advantages america.

Taiwanese officers are additionally monitoring the talks over Intel’s future. For Taiwan, TSMC’s dominance of superior chip manufacturing has grow to be what some commentators name a “silicon defend” that deters navy motion by China and encourages help from america.

Taiwan’s president, Lai Ching-te, stated on Friday that his authorities would work with the island’s semiconductor firms to develop a method addressing Mr. Trump’s grievances whereas defending Taiwan’s function within the chip sector.

“Taiwan’s authorities might be in mutual contact and discussions with the semiconductor sector to formulate the correct technique, after which there’ll be additional deliberation over the proposals with america,” Mr. Lai stated in a information convention.

TSMC might deal with Mr. Trump’s calls for by merely constructing extra manufacturing capability in america, stated Stacy Rasgon, a semiconductor analyst at Bernstein Analysis. TSMC, which received up to $6.6 billion in grants from the CHIPS Act, is constructing three factories in Arizona and has the power to broaden there.

The concept of breaking apart Intel speaks to how a lot the corporate’s fortunes have modified. Based in 1968, it grew to become the world’s Most worthy semiconductor firm by designing and manufacturing chips for private computer systems and information facilities. However the firm has struggled lately to innovate and ceded floor to rivals like Nvidia, the dominant maker of A.I. chips.

Pat Gelsinger, who was named Intel’s chief government in 2021, promised to show the corporate round by reinvigorating its manufacturing enterprise, however the effort faltered. In November, Intel’s board forced Mr. Gelsinger to resign.

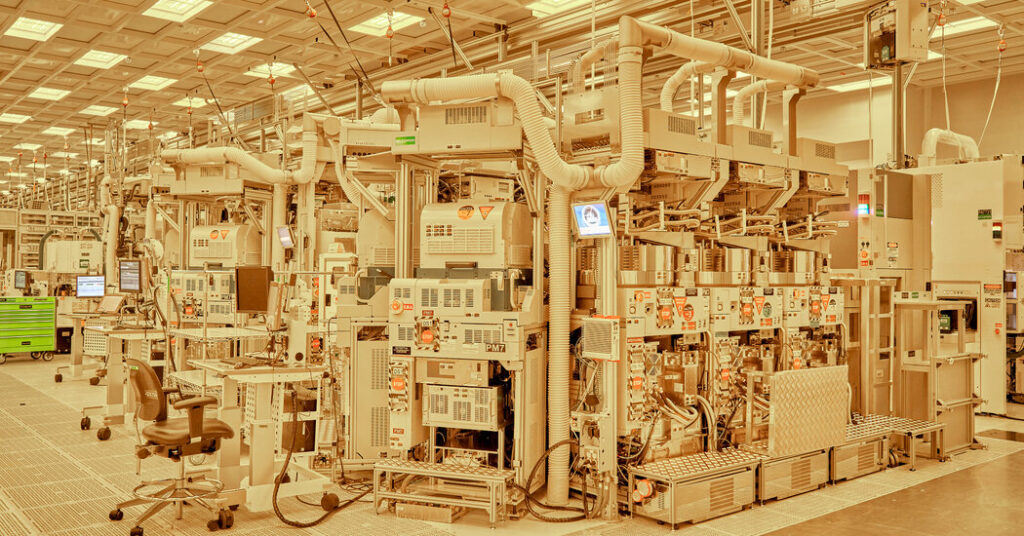

Intel’s manufacturing enterprise, which it calls Intel Foundry, reported an working lack of $13.4 billion in 2024 as gross sales from clients decreased 60 %. Final yr, the corporate stated it deliberate to make the enterprise an independent subsidiary.

With Intel’s inventory value down practically 50 % over the previous yr, splitting Intel might make it weak to a takeover, stated Patrick Moorhead, founding father of Moor Insights and Technique, a tech analysis agency.

“Intel as we all know it will stop to exist,” he stated. “It could be absolutely the finish of an period.”

Chris Buckley contributed reporting from Taipei, Taiwan.